Accounts Payables(AP) Period Closing Process

Before submitting the

Payables Accounting Process

1.

Run the following Standard

reports.

a)

Invoice Register

(with Invalidated Invoices parameter as “YES”).

This report gives the details

of invoices entered into the system, but no action is taken i.e. the status of

the invoice is Never Validated.

b) Invoice on hold Report.

This report gives details

of all the invoices that are on hold in the system. Pass the Parameters as

shown in the Screen Shot below, give the period end date in the To Entered Date

field.

Resolve the Holds in the period end so

that no Invoices are carried forward to the next period during the Year End

Close. In the Month End Closing you can also choose to Sweep the Invoices in

the next period. .

2.

Based on the information

from above reports, take necessary action on invoices. Approve the Unvalidated

Invoices, Account for the Unaccounted Invoices, Release Holds where ever the

Invoices are placed on Hold.

3.

If payment batches are

used, confirm all the Payment Batches.

4.

Submit the Payables

Accounting Process Program to account for transactions. All the transactions

needs to be accounted before transferred to General Ledger.

5.

Run and Review the Standard

report Unaccounted

Transactions Report. Review any unaccounted transactions and correct

data as necessary. Then resubmit the Payables Accounting Process to account for

transactions corrected.

6.

Unposted Payable Journal entries

will be found in the GL and it will be posted into the General ledger.

7.

This will be queried in the

Journal Entry form with source as “Payables” and posting status as “Unposted”.

These Journal entries will be reviewed and Posted into the GL. If Autopost is

scheduled for Payables Invoices, query for any unposted journals that are

remaining after the program runs. Review and post the remaining entries.

8.

After running the “Payables Accounting Process Program” program, run ‘Create Mass Additions’ program from Account

Payables responsibility. This program transfers all the account lines that are

marked as ‘Track as Asset’ and have corresponding Clearing Account set up in

Fixed Assets. (You cannot run this program before Payable Transfer to General

Ledger program is run, as it considers all lines to be interfaced to the Fixed

Assets must be transferred to the General Ledger).

9.

Reconcile with the General

Ledger .The following standard reports from payables module can be used for

reconciliation.

1. Account Payables Trial Balance.

2. Posted Invoice Register.

3.

Posted Payment register.

1.2

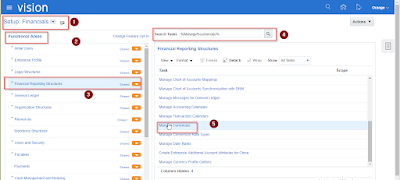

Opening/Closing of AP periods

Navigation: Accounting >

Control Payables Periods.

1.

Complete the Transfer to

General Ledger from the Payables for the period to be closed.

2.

Select the period to close.

Select ‘Closed’ from list of values in the Period Status and save the record. I

3.

If any invoice/s, debit/credit

memo, prepayment, expenses reports are not approved, these will be swept into

the next or decided open/future period. If sweep is required, future period

should be opened before sweeping is done.

4.

Select the Next period to

open. Select ‘Open’ from list of values in the period status and save the

record.

SUBLEDGER PERIOD CLOSE

EXCEPTION REPORT(Before closing period we have to run this report the data will

be no data)

Definitely consider that which you said. Your favourite reason appeared to be at the internet the easiest

ReplyDeletething to be aware of. I say to you, I certainly get

annoyed whilst other people think about issues that they just do not know about.

You managed to hit the nail upon the highest and also defined out the whole thing with no need side-effects ,

folks could take a signal. Will probably be back to get more.

Thank you