What are Types of Prepayment?

Pre-payment invoice are used when there is advance payment made to Suppliers against purchases or Employees for Travel expenses (Impress amount).

Pre payments are two types:

1.Temporary pre-payment

2.Permanent pre-payment.

Temporary pre payments are adjusted against the future purchase invoice. Whereas we cannot adjust Permanent pre payments against future purchases. This payment we can receive when the contract cancelled with the supplier. We can convert Permanent pre-payment into Temporary pre-payment. After conversion we can use that to adjust against future invoices.

Permanent - which is used for long term deposit. Ex:-Fixed deposit, Term deposit

Temporary-which is used for short term advance. Ex:-Advance to supplier

What is payment Request in Oracle Payables?

Payment request is the invoice. If we Refund the money to the Customer In Oracle receivables. The Payment request invoice is automatically generates.

The accounting entry is as follows

Item Expense --- Dr

Liability – Cr

What is the use of permanent prepayment and Accounting entry?

Sometimes suppliers request for advance payment or Deposit to deliver the good or services, so for this type of scenario Oracle provides Prepayment. Accounting entries for Prepayment is

While Creating Prepayment Invoice:

Prepayment --- Dr----It will pick from supplier

Liability – Cr----It will pick from supplier

While Making Payment to Prepayment:

Liability – Dr

Cash – Cr

While applying Prepayment on Standard Invoice:

Liability --- Dr

Prepayment – Cr

Difference between invoice and invoice batch and what setup required?

It’s either, or relation. We have to activate profile option batch% as yes. It will disable the new

button at find screen at invoice.

Explain the P2P process flow

Procure to pay (p2p) is a process of requesting, purchasing, receiving, paying for and accounting for goods and services. Procure to Pay Lifecycle is one of the important business Process in Oracle Applications. It’s the flow that gets the goods required to do business. It involves the transactional flow of data that is sent to a supplier as well as the data that surrounds the fulfillment of the actual order and payment for the product or service.

Create a requisition>> create RFQ>> create a quotation from quote analysis>> generate a PO>>receipt of material>> create Invoice in payables>> transfer to GL

Can we automatically ‘Close’ the Purchase order without receiving the full quantity?

The Receipt Close Tolerance lets you specify a quantity percentage within which Purchasing closes a partially received shipment. For example, if your Receipt Close Tolerance is 5% and you receive 96% of an expected shipment, Purchasing automatically closes this shipment for receiving.

When does a Purchase Order line get the Status ‘Closed for Receiving’?

Goods have been received on the system against this line but an invoice has not been

matched to the order.

Can we match an Invoice against a line even when it is ‘Closed for Invoicing’?

The Close for invoicing status does not prevent you from matching an invoice to a purchase order or to a receipt.

What is Invoice Validation Process?

Before you can pay or create accounting entries for any invoice, the Invoice Validation process must validate the invoice.

Invoice Validation checks the matching, tax, period status, exchange rate, and distribution information for invoices you enter and automatically applies holds to exception invoices. If an invoice has a hold, you can release the hold by correcting the exception that caused Invoice Validation to apply the hold by updating the invoice or the purchase order, or changing the invoice tolerances.

What are the types of invoices?

Standard, Debit memo, Credit memo, Interest, Prepayment, Retainge, Withholding invoice, Expense Report and Payment Request

What is Prepayment and Process?

A prepayment is a type of invoice you enter to make an advance payment. We can adjust prepayment against standard invoice in future.

Can we change invoice if we made the payment?

Yes, we can change if its not accounted and if the amount exceeding the previous amount

otherwise can’t change.

What are the criteria for entering a standard invoice?

Supplier, Supplier site, payment term, payment method, distribution account

What are the modules interfaced through AP module?

Purchasing,GL.

What is the work of payment manager?

We can make payment supplier category wise and for multiple supplier payment in a one

struck.

Can we sweep invoice which is in hold position?

No, We have hold and release that then we can close the period.

What do you mean of retention in AP?what is the accounting entry for retainage releage?

It means holding some part of payment for a contract suppler. Retain value will be release at

the end of the contract. We can make through Retainage invoice.

When Invoice matched with PO accounting entry would be:

Accrual ------ Dr

Liability ---- Cr

Retainage ---Cr----It will pick from financial options

While making payment to the invoice matched with PO:

Liability ---- Dr

Cash --------Cr

When Retainage Release Invoice Matched with PO accounting entry would be:

Retainage --------Dr

Liability ----------- Cr

While making Payment to Retainage Release:

Liability ---Dr

Cash -------Cr

What are the encumbrance options for AP? How are they used?

PO encumbrance and requisition encumbrance available in Financial options.

Encumbrance used to reserve the funds at the time of raising PR or PO.

What are the different types of supplier site?

Purchasing,Pay,Primary pay,RFQ only,Procurement card

How can we default supplier site at invoice level?

Enable primar pay check box in supplier site for that particular site.

What is the use of Withholding invoice and which scenario?and accounting entry?

At the time of doing withholding tax ,this invoice used to generate.

When Withholding tax applied on standard Invoice:

Item Expense --- Dr

Liability --- Cr

Withholding --- Cr-----It will pick from WHT codes

Auto Generated WHT Entry:

Item Expense – Dr

Liability --- Cr

What is the entry for AP invoice?

Expenses Ac Dr 100

To Supplier Ac Cr 100

What is recurring invoice? What is the scenario we are using this?

Repeatedly incurring invoice for expenses that occurs regularly.

Example: Rent for every month and lease payment

What are the methods of accounting?

Accrual and Cash method

What is special calendar & why its required?

Use the Special Calendar window to define periods that Payables uses for automatic

withholding tax, recurring invoices, payment terms, and for the Key Indicators Report. For

example, if you monitor staff productivity weekly, use this window to define weekly periods

for the Key Indicators calendar type.

What is the use of Offset Account method

Three types i.e. None,Balance,Account If we selecting None then Supplier account will be

same for all OU ,If we selesting Balanceing then supplier account will seggregate for OU

wise , if we select Account then its segregare All Code combination as based on real distribution account we have entered for OU wise.

How many types of payment method.

There are 5 types of Payment methods i.e. Bills payable,Check,Electronic,Outsourced Check,Wire

What is pay group?

It is to group invoices in to supplier category for payments.

What is prepayment settlement date in payable option?

Number of days you want Payables to add to the system date to calculate a default settlement

date for a prepayment. Payables prevents you from applying the prepayment to an invoice

until on or after the settlement date.

What is GL date basis in payable option?

The date you want Payables to use as the default accounting date for invoices during invoice

entry.

Invoice Date-Invoice date you enter during invoice entry.

System Date-Current date for your Payables system. The date you enter the invoice.

Goods Received/Invoice Date-Date that you enter in the Date Goods Received field. If no

value is entered, then the invoice date is used.

Goods Received/System Date-Date that you enter in the Date Goods Received field. If no

value is entered, then the system date is used.

What is difference between debit memo and credit memo?

Debit Memo: A negative change in invoiced amount identified by customer and sent to

supplier. Ex.Purchase return

Credit Memo: A negative change in invoiced amount identified by supplier and sent to

customer.Ex:TDS payable.

Both credit memo and debit memos will decrease the supplier balance

What is meant by with-holding tax invoice?

After you apply withholding tax to an invoice, you can optionally create invoices to remit

withheld tax to the tax authority.

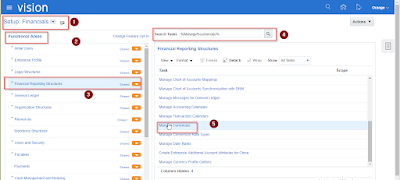

What are the mandatory setups in AP?

Financial option,Payable option,System setup option,Create payment term,Create payment

administrator,Creation of supplier,Open payable period,Open GL period,Open Inventory

period,Open Purchase period,

Can we make foreign currency invoice and payment?

Yes,but in payable option we have to enable use multiple currency and in bank, enable multi

currency payments

Purpose of Payable invoice open interface?

It can use the Payables Open Interface Import program to create Payables invoices from

invoice data in the Payables Open Interface Tables

example: AGIS Transactions are coming to payables through Payables Open Interface Tables

Payable open interface import? (Expense Report Import)?

Use Payables Open Interface Import to import invoices from the Payables Open Interface

Tables.

What is Multi Currency payments?

Multi currency is possible but we have to set up at the time of Bank Creation.

Can we implement MRC at Payables?

Yes, but we have to enable multiple currency option at payable options

What does the Unaccounted Transaction Sweep Report do?

It will sweep the transaction to next period.

What reports should I run before closing the period?

Period close exception report, Unposted transaction

What is the program to transfer data from AP to GL?

Transfer Journal Entries to GL (Parameter-Ledger ,End date)

What is meant by void payments?

When you void a payment, Payables automatically reverses the accounting and payment

records so your general ledger will have the correct information, and so the status of the paid

invoices is reset to Unpaid. Payables also reverses any realized gains or losses on foreign

currency invoices recorded as paid by the payment

What are the types of journal categories available in the AP?

Payable

What is meant by matching and what are the types of matching’s available?

2 way-Invoice and PO, 3 way-Invoice,PO and Receipt and 4 way-Invoice,PO,Receipt and

Inspection

What is a Hold and Release? Types of hold?

Hold means restriction in invoice for further processing.User can define any kind of holds to

hold the invoice for further processing.

Type:-Manual and System hold

How to approve ‘n’ no. of invoices?

You can be Approved n number of invoices using the Request "Invoice Validation"

What is Zero-Payment in AP?

Create zero-amount payments to pay basic invoices with offsetting credit or debit memos, or

to record cancelled invoices as paid so they are no longer included on the Invoice Aging

Report. Before you make a zero-amount payment, you must enable the Allow zero payments in bank accounts

How to transfer funds between your internal banks?

From cash management we can directly transfer the funds between the bank accounts

Can I find out which invoices are matched to a PO?

yes

ERS Invoice means?

Evaluated Receipt settlement Which makes auto invoice in payable.

What is meant by RTS transactions?

Return to supplier which has to assign at the time of creating supplier.

What are the steps to define a Bank?

1. User management-Role-Security wizard through Sys Admin 2.Bank branch 3. Bank

Account 4.Bank Document assignment

How to assign Cash clearing Account ?

While doing bank creation, we have to give cash clearing account.

Pre-payment invoice are used when there is advance payment made to Suppliers against purchases or Employees for Travel expenses (Impress amount).

Pre payments are two types:

1.Temporary pre-payment

2.Permanent pre-payment.

Temporary pre payments are adjusted against the future purchase invoice. Whereas we cannot adjust Permanent pre payments against future purchases. This payment we can receive when the contract cancelled with the supplier. We can convert Permanent pre-payment into Temporary pre-payment. After conversion we can use that to adjust against future invoices.

Permanent - which is used for long term deposit. Ex:-Fixed deposit, Term deposit

Temporary-which is used for short term advance. Ex:-Advance to supplier

What is payment Request in Oracle Payables?

Payment request is the invoice. If we Refund the money to the Customer In Oracle receivables. The Payment request invoice is automatically generates.

The accounting entry is as follows

Item Expense --- Dr

Liability – Cr

What is the use of permanent prepayment and Accounting entry?

Sometimes suppliers request for advance payment or Deposit to deliver the good or services, so for this type of scenario Oracle provides Prepayment. Accounting entries for Prepayment is

While Creating Prepayment Invoice:

Prepayment --- Dr----It will pick from supplier

Liability – Cr----It will pick from supplier

While Making Payment to Prepayment:

Liability – Dr

Cash – Cr

While applying Prepayment on Standard Invoice:

Liability --- Dr

Prepayment – Cr

Difference between invoice and invoice batch and what setup required?

It’s either, or relation. We have to activate profile option batch% as yes. It will disable the new

button at find screen at invoice.

Explain the P2P process flow

Procure to pay (p2p) is a process of requesting, purchasing, receiving, paying for and accounting for goods and services. Procure to Pay Lifecycle is one of the important business Process in Oracle Applications. It’s the flow that gets the goods required to do business. It involves the transactional flow of data that is sent to a supplier as well as the data that surrounds the fulfillment of the actual order and payment for the product or service.

Create a requisition>> create RFQ>> create a quotation from quote analysis>> generate a PO>>receipt of material>> create Invoice in payables>> transfer to GL

Can we automatically ‘Close’ the Purchase order without receiving the full quantity?

The Receipt Close Tolerance lets you specify a quantity percentage within which Purchasing closes a partially received shipment. For example, if your Receipt Close Tolerance is 5% and you receive 96% of an expected shipment, Purchasing automatically closes this shipment for receiving.

When does a Purchase Order line get the Status ‘Closed for Receiving’?

Goods have been received on the system against this line but an invoice has not been

matched to the order.

Can we match an Invoice against a line even when it is ‘Closed for Invoicing’?

The Close for invoicing status does not prevent you from matching an invoice to a purchase order or to a receipt.

What is Invoice Validation Process?

Before you can pay or create accounting entries for any invoice, the Invoice Validation process must validate the invoice.

Invoice Validation checks the matching, tax, period status, exchange rate, and distribution information for invoices you enter and automatically applies holds to exception invoices. If an invoice has a hold, you can release the hold by correcting the exception that caused Invoice Validation to apply the hold by updating the invoice or the purchase order, or changing the invoice tolerances.

What are the types of invoices?

Standard, Debit memo, Credit memo, Interest, Prepayment, Retainge, Withholding invoice, Expense Report and Payment Request

What is Prepayment and Process?

A prepayment is a type of invoice you enter to make an advance payment. We can adjust prepayment against standard invoice in future.

Can we change invoice if we made the payment?

Yes, we can change if its not accounted and if the amount exceeding the previous amount

otherwise can’t change.

What are the criteria for entering a standard invoice?

Supplier, Supplier site, payment term, payment method, distribution account

What are the modules interfaced through AP module?

Purchasing,GL.

What is the work of payment manager?

We can make payment supplier category wise and for multiple supplier payment in a one

struck.

Can we sweep invoice which is in hold position?

No, We have hold and release that then we can close the period.

What do you mean of retention in AP?what is the accounting entry for retainage releage?

It means holding some part of payment for a contract suppler. Retain value will be release at

the end of the contract. We can make through Retainage invoice.

When Invoice matched with PO accounting entry would be:

Accrual ------ Dr

Liability ---- Cr

Retainage ---Cr----It will pick from financial options

While making payment to the invoice matched with PO:

Liability ---- Dr

Cash --------Cr

When Retainage Release Invoice Matched with PO accounting entry would be:

Retainage --------Dr

Liability ----------- Cr

While making Payment to Retainage Release:

Liability ---Dr

Cash -------Cr

What are the encumbrance options for AP? How are they used?

PO encumbrance and requisition encumbrance available in Financial options.

Encumbrance used to reserve the funds at the time of raising PR or PO.

What are the different types of supplier site?

Purchasing,Pay,Primary pay,RFQ only,Procurement card

How can we default supplier site at invoice level?

Enable primar pay check box in supplier site for that particular site.

What is the use of Withholding invoice and which scenario?and accounting entry?

At the time of doing withholding tax ,this invoice used to generate.

When Withholding tax applied on standard Invoice:

Item Expense --- Dr

Liability --- Cr

Withholding --- Cr-----It will pick from WHT codes

Auto Generated WHT Entry:

Item Expense – Dr

Liability --- Cr

What is the entry for AP invoice?

Expenses Ac Dr 100

To Supplier Ac Cr 100

What is recurring invoice? What is the scenario we are using this?

Repeatedly incurring invoice for expenses that occurs regularly.

Example: Rent for every month and lease payment

What are the methods of accounting?

Accrual and Cash method

What is special calendar & why its required?

Use the Special Calendar window to define periods that Payables uses for automatic

withholding tax, recurring invoices, payment terms, and for the Key Indicators Report. For

example, if you monitor staff productivity weekly, use this window to define weekly periods

for the Key Indicators calendar type.

What is the use of Offset Account method

Three types i.e. None,Balance,Account If we selecting None then Supplier account will be

same for all OU ,If we selesting Balanceing then supplier account will seggregate for OU

wise , if we select Account then its segregare All Code combination as based on real distribution account we have entered for OU wise.

How many types of payment method.

There are 5 types of Payment methods i.e. Bills payable,Check,Electronic,Outsourced Check,Wire

What is pay group?

It is to group invoices in to supplier category for payments.

What is prepayment settlement date in payable option?

Number of days you want Payables to add to the system date to calculate a default settlement

date for a prepayment. Payables prevents you from applying the prepayment to an invoice

until on or after the settlement date.

What is GL date basis in payable option?

The date you want Payables to use as the default accounting date for invoices during invoice

entry.

Invoice Date-Invoice date you enter during invoice entry.

System Date-Current date for your Payables system. The date you enter the invoice.

Goods Received/Invoice Date-Date that you enter in the Date Goods Received field. If no

value is entered, then the invoice date is used.

Goods Received/System Date-Date that you enter in the Date Goods Received field. If no

value is entered, then the system date is used.

What is difference between debit memo and credit memo?

Debit Memo: A negative change in invoiced amount identified by customer and sent to

supplier. Ex.Purchase return

Credit Memo: A negative change in invoiced amount identified by supplier and sent to

customer.Ex:TDS payable.

Both credit memo and debit memos will decrease the supplier balance

What is meant by with-holding tax invoice?

After you apply withholding tax to an invoice, you can optionally create invoices to remit

withheld tax to the tax authority.

What are the mandatory setups in AP?

Financial option,Payable option,System setup option,Create payment term,Create payment

administrator,Creation of supplier,Open payable period,Open GL period,Open Inventory

period,Open Purchase period,

Can we make foreign currency invoice and payment?

Yes,but in payable option we have to enable use multiple currency and in bank, enable multi

currency payments

Purpose of Payable invoice open interface?

It can use the Payables Open Interface Import program to create Payables invoices from

invoice data in the Payables Open Interface Tables

example: AGIS Transactions are coming to payables through Payables Open Interface Tables

Payable open interface import? (Expense Report Import)?

Use Payables Open Interface Import to import invoices from the Payables Open Interface

Tables.

What is Multi Currency payments?

Multi currency is possible but we have to set up at the time of Bank Creation.

Can we implement MRC at Payables?

Yes, but we have to enable multiple currency option at payable options

What does the Unaccounted Transaction Sweep Report do?

It will sweep the transaction to next period.

What reports should I run before closing the period?

Period close exception report, Unposted transaction

What is the program to transfer data from AP to GL?

Transfer Journal Entries to GL (Parameter-Ledger ,End date)

What is meant by void payments?

When you void a payment, Payables automatically reverses the accounting and payment

records so your general ledger will have the correct information, and so the status of the paid

invoices is reset to Unpaid. Payables also reverses any realized gains or losses on foreign

currency invoices recorded as paid by the payment

What are the types of journal categories available in the AP?

Payable

What is meant by matching and what are the types of matching’s available?

2 way-Invoice and PO, 3 way-Invoice,PO and Receipt and 4 way-Invoice,PO,Receipt and

Inspection

What is a Hold and Release? Types of hold?

Hold means restriction in invoice for further processing.User can define any kind of holds to

hold the invoice for further processing.

Type:-Manual and System hold

How to approve ‘n’ no. of invoices?

You can be Approved n number of invoices using the Request "Invoice Validation"

What is Zero-Payment in AP?

Create zero-amount payments to pay basic invoices with offsetting credit or debit memos, or

to record cancelled invoices as paid so they are no longer included on the Invoice Aging

Report. Before you make a zero-amount payment, you must enable the Allow zero payments in bank accounts

How to transfer funds between your internal banks?

From cash management we can directly transfer the funds between the bank accounts

Can I find out which invoices are matched to a PO?

yes

ERS Invoice means?

Evaluated Receipt settlement Which makes auto invoice in payable.

What is meant by RTS transactions?

Return to supplier which has to assign at the time of creating supplier.

What are the steps to define a Bank?

1. User management-Role-Security wizard through Sys Admin 2.Bank branch 3. Bank

Account 4.Bank Document assignment

How to assign Cash clearing Account ?

While doing bank creation, we have to give cash clearing account.