Year End Process

Use

the following checklist as a guideline to perform year-end processing in Oracle

General Ledger for your ledgers.

Set

the status of the first accounting period in the new fiscal year to Future

Entry.

Note: It is advisable not to open the first period of

the new fiscal year until all of the year-end processing for the last period of

the current year has completed.

§ (Optional)

If you are required to have an actual closing journal entry that shows the

closing of your income statement accounts to retained earnings, submit the

Create Income Statements Closing Journals program. This program creates an

auditable closing journal entry.

§ (Optional)

If you submitted the Create Income Statement Closing Journals program, post the

closing journals to update account balances. Your income statement will reflect

zero balances.

§ (Optional),

Submit the Create Balance Sheet Closing Journals program. Post the Balance

Sheet Closing Journal. Your balance sheet will now reflect zero balances.

§ Close

the last period of the fiscal year and Open the first period of the new fiscal

year using the Open and Close Periods window.

§ Opening

the first period of a new year automatically closes out your income statement

and posts the difference to your retained earnings account specified for your

ledger in the Accounting Setup Manager.

§ Note: If you have already run the Create Income

Statement Closing Journals program, where the closing account specified was the

retained earnings account, opening the new fiscal year has no further impact on

retained earnings because the income statement accounts now have zero balances.

§ In

the first adjusting period of the new fiscal year, reverse the balance sheet

closing journals to repopulate the balance sheet accounts. Post the generated

reversing journals.

Income Statement Closing

General Ledger provides two

options for the Income Statement Closing Journals. You can choose to zero out

each income statement account, and post the balance to the retained earnings

account. Alternatively, you can post the reciprocal of the net income balance

to an income statement offset account instead of zeroing out each revenue and

expense account.

The

Income Statement Closing Journals program generates journals to close out the

year - to - date (YTD) actual balances of a range of revenue and expense

accounts. The Income Statement Closing Journals program can accept two account

templates as parameters for the closing journal.

The

Retained Earnings account template

The

Income Statement Offset account template

The

Retained Earnings account template is a required parameter. The Income Offset

account template is an optional parameter.

Option 1: Income Statement

Close

When you run the process,

Create Income Statement Closing Journals, and you enter an account for the

field, Closing Account in the Parameters window, entries are posted against

each revenue and expense account in the account range processed. It is the

reciprocal of the account's YTD balance and zeroes out each account. The amount

posted to the retained earnings account is effectively the net sum of the

revenue and expense accounts' YTD balances.

If there are income

statement balances in both the ledger currency and entered currencies of a ledger,

the closing process produces a journal batch that contains separate journals

for each currency processed. For the ledger currency, the journal will only

have entered amounts as converted amounts do not apply. For entered currencies,

the journal will have both entered and converted amounts.

Stat account balances are

not processed by the program.

When you run the process,

Create Income Statement Closing Journals, and you enter an account for the

fields, Closing Account and Income Offset Account in the Parameters

window, the journal generated will be similar to that described above except

for the following:

The revenue and expense

accounts included in the specified account range will not be zeroed out.

Instead, the program will take the net sum of the revenue and expense accounts.

This sum includes the balance in the income statement offset account. It will

then post the reciprocal of the net sum to the income offset account, in the

appropriate debit (DR) or credit (CR) column.

The amount posted to the

retained earnings account will be the reciprocal of the amount posted to the

income offset account. This retained earnings amount will then also be equal to

the net sum of the revenue and expense accounts processed.

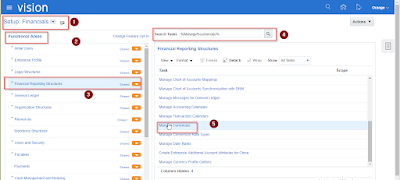

Runà

Create Income Statement Closing Journals

Before running the process,

Create Income Statement Closing Journals, review the following activities for

the ledgers you plan to close. If you use reporting currencies (journal and

subledger level), review the following activities for the reporting currencies

you plan to close.

ü Post

all revenue and expense adjustment entries to the appropriate periods.

ü Print

General Ledger accounting and analysis reports.

ü Ensure

the period you are closing is an Open period.

ü If

you have accounts you want to process that have any of the following

attributes:

ü Enabled

flag was disabled

ü Allow

Posting flag was disabled

ü Effective

date is out of range

Temporarily

re-enable the account to post the generated closing journal. The Segment Value

Inheritance program can help you temporarily re-enable these accounts. Use the

Segment Value Inheritance program to disable these accounts once the closing

journal has been posted.

1.

Run the close process,

Create Income Statement Journals in the adjusting period that represents the

last day of your fiscal year or the period you want to close for your ledger or

ledger set.

2.

In the Parameters window,

enter an account in the Closing Account field. The Category field below

defaults to display Income Close.

3.

If you are closing a period

and you entered an account for the Closing Account and Income Offset Account

fields in the Parameters window, submit your request to generate closing

journals. The category field below defaults to display Income Offset.

4.

Post the income statement

closing journals to update year-to-date actual balances or period to date

actual balances. If you chose the Income Statement Offset option, proceed to

your next open period.

Note: Should

you need to make adjustments for your ledger after their income statement

closing journals are posted, reverse and post the original closing entries,

make your adjustments, then rerun the closing process to capture the new

adjustments for that ledger.

5.

Run the Open Period program

to open the first period of the new fiscal year. This program closes out all

revenue and expense accounts to the Retained Earnings account. However, because

posting of the closing journals has already zeroed out the revenue and expense

accounts to the Retained Earnings account, there are no balances to transfer

and no further effect on Retained Earnings.

6.

If revenue and expense

adjustments need to be made after opening the new fiscal year for your ledger,

posting those back - dated adjustments will automatically update the beginning

balances of the Retained Earnings account for all open periods in the New Year.

However, amounts in the closing journal will not reflect the adjustments. For

accuracy, you must reverse the closing journals, post, enter your adjustments,

run the Create Income Statement Closing Journals, and post for your ledger.

Balance Sheet Closing

When you run Create Balance

Sheet Closing Journals, journal entries are created to reverse debits and

credits of ending year-to-date actual balances for the period you want to

close. The balance, which is the net of the reversed asset and liability

accounts, is transferred to the closing account you specify.

Note:

Your balance sheet should be balanced if you

completed the Close Process: Create Income Statement Closing Journals to update

the retained earnings account. If the range of balance sheet accounts is

balanced, then there is no transfer of balances.

Before running this program,

review the following activities for the ledgers you plan to close.

Create an accounting

calendar that includes two adjusting periods: one for the last day of the

fiscal year you are closing, and one for the first day of the new fiscal year.

This does not affect account balances in periods used for reporting.

ü Post

any adjustment entries to the appropriate periods.

ü Print

General Ledger accounting and analysis reports.

ü Ensure

the period you are closing is an Open period.

RunàCreate

Balance Sheet Closing Journal

1.

Run the close process,

Create Balance Sheet Closing Journals in the last adjusting period of the

fiscal year you want to close for your ledger or ledger set.

Note: If

you want to run the close process for your primary ledger and the associated

secondary ledgers simultaneously, create a ledger set that contains all of the

ledgers. Then run the close process for the ledger set so that they can all be

processed from a single submission.

2.

Post the balance sheet

closing journals to zero-out balance sheet account balances.

Note: Should

you need to make adjustments for your ledger after their balance sheet closing

journals are posted, reverse and post the original closing entries, make your

adjustments, then rerun the closing process to capture the new adjustments for

that ledger.

3.

In the first adjusting

period of the new fiscal year, reverse the balance sheet closing journals to

repopulate the balance sheet accounts.

4.

Post the generated reversing

journals.