Receivables Activities

Define receivables activities to default accounting information for certain activities, such as miscellaneous cash, discounts, late charges, adjustments, and receipt write-off applications.

Activities that you define appear as list of values choices in various Receivables windows. You can define as many activities as you need.

The Tax Rate Code Source you specify determines whether Receivables calculates and accounts for tax on adjustments, discounts, and miscellaneous receipts assigned to this activity. If you specify a Tax Rate Code Source of Invoice, then Receivables uses the tax accounting information defined for the invoice tax rate code(s) to automatically account for the tax. If the Receivables Activity type is Miscellaneous Cash, then you can allocate tax to the Asset or Liability tax accounts that you define for this Receivables Activity.

Receivables uses Late Charges activity's accounting information when you record late charges as adjustments to overdue transactions.

Query the Chargeback Adjustment activity that Receivables provides and specify GL accounts for this activity before creating chargebacks in Receivables.

Query the Credit Card Chargeback activity that Receivables provides and specify a GL clearing account for this activity, before recording credit card chargebacks in Receivables.

You can make an activity inactive by unchecking the Active check box and then saving your work.

Attention: Once you define an activity, you cannot change its type. However, you can update an existing activity's GL account, even if you have already assigned this activity to a transaction.

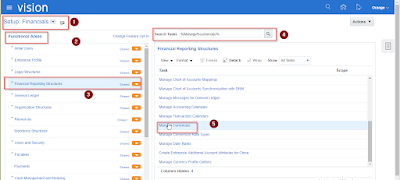

Prerequisites

If you use Receivables with an installed version of Oracle General Ledger, your Accounting Flexfields are already set up. If you are using Receivables as an Oracle Financials standalone product, you must define the Accounting Flexfield and the GL accounts for each receivables activity that you plan to use to reflect your current accounting structure.

An activity's type determines whether it uses a distribution set or GL account and in which window your activity appears in the list of values. You can choose from the following types:

Adjustment: You use activities of this type in the Adjustments window. You must create at least one activity of this type.

Note: In the Adjustments window, you cannot select the Adjustment Reversal, Chargeback Adjustment, Chargeback Reversal, and Commitment Adjustment activities to manually adjust transactions. These four activities are reserved for internal use only, and should not be end dated.

When you reverse a receipt, if an adjustment or chargeback exists, Receivables automatically generates off-setting adjustments using the Adjustment Reversal and Chargeback Reversal activities. When your customers invoice against their commitments, Receivables automatically adjusts the commitment balance and generates an off-setting adjustment against the invoice using the Commitment Adjustment activity.

Bank Error: You use activities of this type in the Receipts window when entering miscellaneous receipts. You can use this type of activity to help reconcile bank statements using Oracle Cash Management.

Claim Investigation: You use activities of this type in the Receipts Applications and QuickCash windows when placing receipt overpayments, short payments, and invalid Lockbox transactions into claim investigation. The receivable activity that you use determines the accounting for these claim investigation applications.

For use only with Oracle Trade Management.

Credit Card Chargeback: Use activities of this type in the Receipts Applications window when recording credit card chargebacks. This activity includes information about the General Ledger clearing account used to clear the chargebacks. Receivables credits the clearing account when you apply a credit card chargeback, and then debits the account after generating the negative miscellaneous receipt. If you later determine the chargeback is invalid, then Receivables debits the clearing account when you unapply the credit card chargeback, and then credits the account after reversing the negative miscellaneous receipt. Only one activity can be active at a time.

Credit Card Refund: You use activities of this type in the Receipts Applications window when processing refunds to customer credit card accounts. This activity includes information about the General Ledger clearing account used to clear credit card refunds. You must create at least one activity of this type to process credit card refunds.

Earned Discount: You use activities of this type in the Adjustments and the Remittance Banks windows. Use this type of activity to adjust a transaction if payment is received within the discount period (determined by the transaction's payment terms).

Endorsements: The endorsement account is an offsetting account that records the endorsement of a bill receivable. This is typically defined with an Oracle Payables clearing account.

Late Charges: You use activities of this type in the System Options window when you define a late charge policy. You must define a late charge activity if you record late charges as adjustments against overdue transactions. If you assess penalties in addition to late charges, then define a separate activity for penalties.

Miscellaneous Cash: You use activities of this type in the Receipts window when entering miscellaneous receipts. You must create at least one activity of this type.

Payment Netting: You use activities of this type in the Applications window and in the QuickCash Multiple Application window when applying a receipt against other open receipts.

The GL Account Source field defaults to Activity GL Account and you must enter a GL account in the Activity GL Account field. The GL account that you specify will be the clearing account used when offsetting one receipt against another receipt. The Tax Rate Code Source field defaults to None.

You can define multiple receivables activities of this type, but only one Payment Netting activity can be active at any given time.

Prepayments: Receivables uses activities of this type in the Applications window when creating prepayment receipts. When the Prepayment activity type is selected, the GL Account Source field defaults to Activity GL Account and you must enter a GL account in the Activity GL Account field. The GL account that you specify will be the default account for prepayment receipts that use this receivables activity. The Tax Rate Code Source field defaults to None. You can define multiple receivables activities of this type, but only one prepayment activity can be active at any given time.

Receipt Write-off: You use activities of this type in the Receipts Applications and the Create Receipt Write-off windows. The receivable activity that you use determines which GL account is credited when you write off an unapplied amount or an underpayment on a receipt.

Refund: Use activities of this type in the Applications window to process automated non-credit card refunds. This activity includes information about the General Ledger clearing account used to clear refunds. Create at least one activity of this type. Only one activity can be active at a time.

Short Term Debt: You use activities of this type in the GL Account tabbed region of the Remittance Banks window. The short-term debt account records advances made to creditors by the bank when bills receivable are factored with recourse. Receivables assigns short-term debt receivables activities to bills receivable remittance receipt methods.

Unearned Discount: You use activities of this type in the Adjustments and the Remittance Banks windows. Use this type of activity to adjust a transaction if payment is received after the discount period (determined by the transaction's payment terms).

Greetings! Very useful advice within this article! It's the little changes that will

ReplyDeletemake the most significant changes. Many thanks for sharing!

What's up, all is going perfectly here and ofcourse every

ReplyDeleteone is sharing data, that's genuinely excellent, keep up writing.

I do believe all the ideas you have introduced to your post.

ReplyDeleteThey're really convincing and will definitely work.

Still, the posts are too quick for newbies. May you please prolong them a little from subsequent

time? Thanks for the post.

After entering the coding in receivable activities, any error occurred, where we can go correct it

ReplyDeleteHi! I simply widh too offer you a huge thumbs up for the excellent

ReplyDeleteinfo you've got hwre on this post. I'll be returning to your website for more soon.