How to create Custom Depreciation method in Oracle Fixed Assets.

Requirement:

There is an asset with cost of 10000. The life

of asset is 3 years. Salvage value is 5%. Now if you want to calculate the

depreciation with WDV method (63.16%) with life basis. And if you want

to calculate the depreciation on salvage value.

For this we use the Calculated type Depreciation Method , system will not take the depreciation

rate. And also you cannot calculate the depreciation salvage value.

If you use the Flat rate method, we cannot use the life of asset.

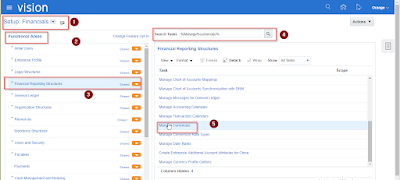

So for this we need to create a new depreciation method with

formula method.

Create

a new asset with this depreciation method

Theoretical calculations for the above case

asset cost =10000

|

|||||||

dep rate = 0.6316

|

2016 has 366 days

|

||||||

NBV

|

Depraciation/yr

|

Depreciation/day

|

depreciation/30 days

|

||||

1st Year

|

=6316/366=

17.256

|

||||||

10000

|

6316

|

=10000-6316=

3684

|

17.2568306

|

517.704918

|

|||

2nd Year

|

|||||||

3684

|

2326.8144

|

1357.186

|

6.374833973

|

191.2450192

|

|||

3rd Year

|

|||||||

1357.186

|

857.198425

|

499.9872

|

2.348488836

|

70.45466507

|

|||

after 3 years the NBV is the salvage value=500

|

|||||||

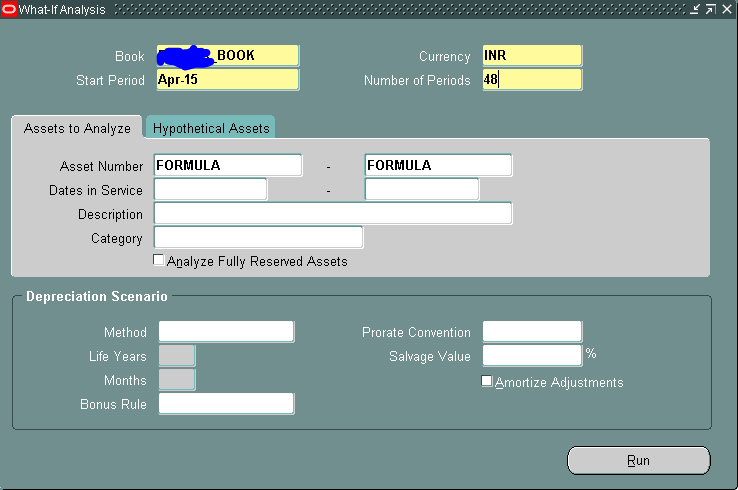

Now run the what if analysis for this asset.

Open the report output, and check the depreciation for each

period.

In this way we can achieve the depreciation calculations