Automatic Offset And Pooled Accounts In Oracle Payables

PURPOSE OF AUTOMATIC OFFSETS AND POOLED ACCOUNTS

- If you enter invoices for expense or asset purchases for more than one balancing segment,you may want to use Automatic Offsets to keep your Payables transaction entries balanced at the balancing segment level.

- For an invoice, Payables creates offsetting liability distributions; for a payment, Payables creates offsetting cash and discount taken distributions. This helps to ensure that each set of accounts remains balanced by balancing segment.

- Automatic Offsets was created for the government and higher education sectors where it is mandated by law that transactions be balanced to the balancing segment level. However, many companies may benefit from the option of having self–balancing sets of accounts. For example, if you have a product segment in your account, Automatic Offsets would allow you to track cash and AP liability by product.

Important: The level of detail that Automatic Offsets

provides is only recommended either if it is mandated by law or if it is

necessary to produce a balance sheet at a balancing segment level. There are

restrictions associated with enabling Automatic Offsets. Be sure you understand

the impact of Automatic Offsets before deciding to implement this feature.

- Alternatively, you can set up Intercompany Accounting in Oracle General Ledger so that General Ledger automatically creates the intercompany accounting entries necessary to balance a transaction at the balancing segment level.

- If you choose to use Intercompany Accounting rather than Automatic Offsets, your Payables transactions that cross multiple balancing segments will not balance at the balancing segment level until you transfer them to General Ledger and submit the Journal Import program.

- By enabling Automatic Offsets within Payables, Payables will automatically allocate the liability, discount taken, and gain and loss entries for a given invoice across multiple balancing segments, according to the balancing segments of the invoice distributions.

If you pay an invoice

from a pooled bank account, Payables will also automatically allocate the cash

entry across multiple balancing segments, according to the balancing segments

on the invoice distributions.

If you pay from a non– pooled bank account, Payables records

the cash entry using the Cash Account you specify in the Banks window.

- Entries in accounts other than liability, cash, discount taken, or realized gain/loss must have manual journal entries made in your general ledger in order to keep the entries balanced at the balancing segment level. Automatic Offsets will not affect these accounts. If you do not enable Automatic Offsets Payables records the liability, cash, discount taken, and gain and loss entries in the accounts you specify in the Payables Options and Banks windows.

- These accounts have one balancing segment each, so if you enter transactions that cross multiple balancing segments, you may want to consider using the Intercompany Accounting feature to balance these transactions during posting.

Automatic offsets allows you to automatically balance

invoice and payment distributions that cross balancing segments by creating

offsetting entries for each balancing segment.

To determine if automatic offsets is right for your company,

you should consider the following information:

1. Do you need the level of detail automatic offsets

provides, either because it is mandated by law, or because you need to produce

a balance sheet that will balance at the segment level?

2. Are you aware of the restrictions that Automatic Offsets

enforces?

3. Are you aware of the alternatives?

You can set up Intercompany Accounting in Oracle General

Ledger so that the General Ledger automatically creates the intercompany

accounting entries necessary to balance a transaction at the balancing segment

level.

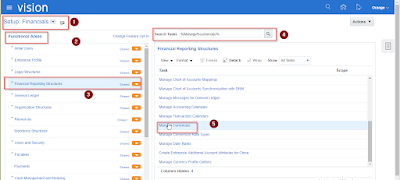

SETTING UP AUTOMATIC OFFSETS AND POOLED ACCOUNTS

Payables will automatically create balancing entries for

your invoice and payment transactions when you enable Automatic Offsets. To use

this feature, navigate to Payables

options : Accounting region and select either Account or Balancing as your

Automatic Offset Method.

Account – Payables retains all segments but the

distribution’ s account segment when it builds an offsetting account. Use this

option if you want all of your accounts to preserve the same level of

distribution detail.

Balancing – Payables

retains only the distribution’s balancing segment when it builds an offsetting

account. Companies typically find this level of detail sufficient.

Prorate Discounts – To prorate discounts across your invoice

distributions when you pay an invoice that crosses multiple balancing segments,

navigate to Setup>Options>Payables: Payment region and select

System Account as your Discount Distribution Method.

The balancing segment

of your system Discount Taken Account is replaced by the balancing segment from

the offsetting invoice distribution when Payables builds the accounts for these

entries.

Pooled Account – To create a pooled account, navigate to

Bank Accounts button; in the Payables Options region check the pooled account

box.

If you enable Automatic Offsets, you cannot use any of the

following Payables options:

Allow Adjustments to Paid Invoices – When an invoice is

paid or partially paid, you cannot adjust any accounting information on the

invoice. Payables prevents you from updating or reversing any of the invoice

distributions for paid or partially paid invoices because Payables has already

created the payment distributions based on the current invoice accounting

lines. Navigation: Setup>Options>Payables: Invoice Region –

“Allow Adjustments to Paid Invoices”

Allow Reconciliation Accounting – If you enable Automatic

Offsets, Payables will not create reconciliation accounting entries, however

you can still clear payments using Oracle Cash Management. Navigation:

Setup>Options>Payables: Accounting Region – “Allow Reconciliation

Accounting”

Automatic Withholding Tax – You cannot use Automatic

Withholding Tax if you have enabled Automatic Offsets in Payables. Navigation:

Setup>Options>Payables: Withholding Tax Region – “Use Withholding

Tax”

AUTOMATIC OFFSETS AND INVOICE PROCESSING

When Automatic Offsets is used, Payables automatically

allocates an invoice’ s liability amount across multiple balancing segments

according to the balancing segments on the invoice distributions. This ensures

that invoices always balance by balancing segment.

Payables creates the

liability distributions when you submit the invoice for Approval. You can

review the liability distributions on the “Expense Distribution Detail Report.”

If you don’t use Automatic Offsets, Payables records the

invoice liability using the liability account on the invoice, which defaults

from the supplier site. When you distribute invoice distributions across

multiple balancing segments, the invoice will not balance by balancing segment.

However, General Ledger can automatically create intercompany balancing entries

when you post the invoice if you have enabled the Balance Intercompany Journals

option for your set of books. (Navigation: GL responsibility -Setup>

Financial>Books>Define).

When you use Automatic Offsets and submit

Approval for an invoice, Payables automatically builds the offsetting liability

account for each invoice distribution on the basis of the default liability

account for the invoice, which defaults from the supplier site. You can

override this default during invoice entry. Payables gives you a choice of two

different methods for building your offsetting accounts on the basis of this

default: Account or Balancing.

As previously mentioned, if you select Balancing as your

Automatic Offset Method, Payables takes the default liability account for the

invoice, substitutes the balancing segment from the invoice distribution and

uses that as the distribution’ s offsetting liability account.

Example: You enable Automatic Offsets using the Balancing

method, and your Accounting Flexfield structure is Balancing Segment–Cost

Center–Account. Your default liability account for supplier site ABC is

100–000–2000. You enter an invoice for this site and distribute it as follows:

DR 100–100–4100 $60

DR 200–201–4200 $40

Payables automatically records the following liability

account offsets when you approve the invoice:

CR 100–000–2000 $60

CR 200–000–2000 $40

If you select Account as your Automatic Offset Method,

Payables takes the account used for the invoice distribution and substitutes

the account segment from the default liability account for the invoice,

preserving all other segment values.

Example: You enable Automatic Offsets using the Account

method, and your Accounting Flexfield structure is Balancing Segment–Cost

Center–Account. Your default liability account for supplier site ABC is

100–000–2000. You enter an invoice for this site and distribute it as follows:

DR 100–100–4100 $60

DR 200–201–4200 $40

Payables automatically records the following liability

account offsets when you approve the invoice:

CR 100–100–2000 $60

CR 200–201–2000 $40

If you adjust the liability account or an invoice

distribution account for an unpaid invoice, you must resubmit Approval to pay

or post the invoice. At that point Payables automatically adjusts the balancing

liability distributions created by Automatic Offsets.

Note:When an invoice is paid or partially paid, you can’t

adjust any accounting information on the invoice. You will be prevented from

reversing or updating any of the invoice distributions for paid or partially

paid invoices because Payables has already created the payment distributions

based on the current invoice accounting lines.

When you enter invoices with tax, freight or miscellaneous

charges, you may want to prorate these expenses in the Distributions window of

the Invoice Workbench to ensure that the expenses are distributed across the

other invoice distributions.

If you have a prepayment that crosses multiple balancing

segments, you must split it up into the

appropriate number of prepayments,

since Payables does not support multiple distributions for prepayments. If you

use Automatic Offsets, Payables automatically creates liability distributions

based on your chosen Automatic Offset Method, just as it does for any other

invoice.

If you use Automatic Offsets and have chosen System

Account as your Discount Distribution Method in the Payables Options window,

Payables prorates the entire discount amount across your invoice distributions

when you pay an invoice that crosses multiple balancing segments. The balancing

segment from the offsetting invoice distribution replaces the balancing segment

of your system Discount Taken account when Payables builds the accounts for

these entries.

If you enable the

Automatic Offsets and Pooled Account option, Payables creates a corresponding

cash payment distribution for each liability distribution that you pay using a

bank account with this option enabled. Payables uses the cash account you

define for the bank account with the Automatic Offset Method you choose in the

Payables Options window to create the cash payment distributions. If you enable

Automatic Offsets, you can choose to pool any or all of your bank accounts.

Multiple balancing segments share the cash in a pooled bank account; the cash in

a non-–pooled bank account is associated with a single balancing segment. If

you do not enable Automatic Offsets, you can only have non–pooled bank

accounts.

When you create a payment from a pooled bank account using

Automatic Offsets, Payables automatically builds the cash account for each

payment distribution on the basis of the bank account’ s associated cash

account. Payables use the Automatic Offset Method you specified when you

enabled this feature in building these cash accounts.

• If you selected Balancing as your Automatic Offset Method,

Payables takes the cash account associated with your pooled bank account,

substitutes the balancing segment from the invoice distribution and uses that

as the distribution’ s offsetting cash account.

• If you selected Account as your Automatic Offset method,

Payables takes the account used for the invoice distribution and substitutes

the account segment from the cash account associated with your pooled bank

account, preserving all other segment values.

Example: You enable Automatic Offsets using the Balancing

method, and your Accounting Flexfield structure is Balancing Segment–Cost

Center–Account. Your default liability account for supplier site ABC is

101–000–2300. The default cash account for your Division A bank account, in

which you have pooled funds for investment, is 101–000–1100. You enter an

invoice for supplier site ABC and distribute it as follows:

DR 101–100–4500 $60

DR 200–201–4610 $40

Payables records the following liability account offsets automatically

when you approve the invoice:

CR 101–000–2300 $60

CR 200–000–2300 $40

You post the invoice and pay it out of your Division A bank

account. When you create the payment, Payables automatically creates the

following entries:

DR 101–000–2300 $60

DR 200–000–2300 $40

CR 101–000–1100 $60

CR 200–000–1100 $40

Example: You enable Automatic Offsets using the Account

method, and your Accounting Flexfield structure is Balancing Segment–Cost

Center–Account. Your default liability account for supplier site ABC is

101–000–2300. The default cash account for your Division A bank account, in

which you have pooled funds for investment, is 101–000–1100. You enter an

invoice for supplier site ABC and distribute it as follows:

DR 101–100–4500 $60

DR 200–201–4610 $40

Payables records the following liability account offsets

automatically when you approve the invoice:

CR 101–100–2300 $60

CR 200–201–2300 $40

You post the invoice and pay it out of your Division A bank

account. When you create the payment, Payables automatically creates the

following entries:

DR 101–100–2300 $60

DR 200–201–2300 $40

CR 101–100–1100 $60

CR 200–201–1100 $40

Attention: When you make a payment using a non–pooled bank

account, Payables generates only a single cash offset even if Automatic Offsets

is enabled. For payment distributions that cross balancing segments, you can

either enter balancing entries manually, or set General Ledger up to create

them automatically on posting.

Automatic Offsets and Pooled Accounts are very useful

options for keeping invoice and payment distributions that cross balancing

segment in balance. However, enabling these option does restrict some functions

in the system and there are alternatives. Review all of the costs and benefits

of enabling these options before implementing. And make sure you continue to

use the features correctly after implementing.