Oracle receivables

Mandatory setups:

1.

Defining party tax profile and

e-business tax setups

2.

Defining system options

3.

Payment terms

4.

Statement cycle

5.

Collector

6.

Auto cash rule set

7.

Customer

8.

Define frieght & carrier

9.

Item valid org

10.

Receivables activities

11.

Auto accounting

In receivables there are four work benches

1.

Transaction work bench

2.

Receipt work bench

3.

Collection work bench

4. Bills

receivables

Transaction

workbench:

There are six types of transaction classes in oracle

receivables.

1. Invoice

2. Debit

memo

3. Credit

memo

4. Deposit

5. Guarantee

6. Charge

back

For each type of class, we must create transaction type and then transaction source.

Transaction

type, Is decides the transaction properties like class,

printing option, freight, line sign and etc. it is also defaults some code

combinations I.e. tax, freight, bills receivables, unbilled amount,

receivables, revenue and unearned revenue.

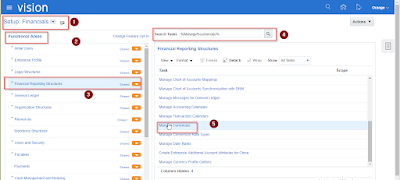

Creating an AR RESP:

for receivables menu

----àAR_NAVIGATE_GUI

request group ----à

RECEIVABLES ALL

After defining the

responsibility we have to attach the following profile options

1.

GL LEDGER NAME--àhere

we can attach the ledger

2.

GL: DATA ACCESS SET ---àif

we attach the GL LEDGER NAME profile option, the same ledger it takes

defaultly. If we want to use multiple ledgers for single responsibility. Create

ledger set and attach the ledger set in place of ledger.

3.

HR: SECURITY PROFILE ---àhere

we have to attach business group

4.

HR: BUSINESS GROUP ----à

if we attach HR: SECURITY PROFILE option, the same business group it takes

5.

MO: OPERATING UNIT ---àattach the

operating unit

6.

MO: SECURITY PROFILE---àif

we have multiple organization units, create security profile from hrms resp and

run security list maintenance program. And then attach security profile list

here.

n

Creating party tax profile

This can be done in E-business module.

For every OU , we must create party tax profile otherwise it

creates problem while creating receivable activities

Defining system options:

Define system options to customize your Receivables

environment. During Receivables setup, you specify your accounts, customer and

invoice parameters, and how the AutoInvoice and Automatic Receipts programs

will run.

It has four tabs

1.

Accounting

2.

Trans and customers

3.

Claims

4.

Miscellaneous

the accounts which are given in the aboce are defaults to the reeceivable cross currecncy transactions.

In this tab, we are entering the transaction properties and auto invoice creation setups.

if we check the allow unearned discounts then only we can give the unearned discounts to the customer

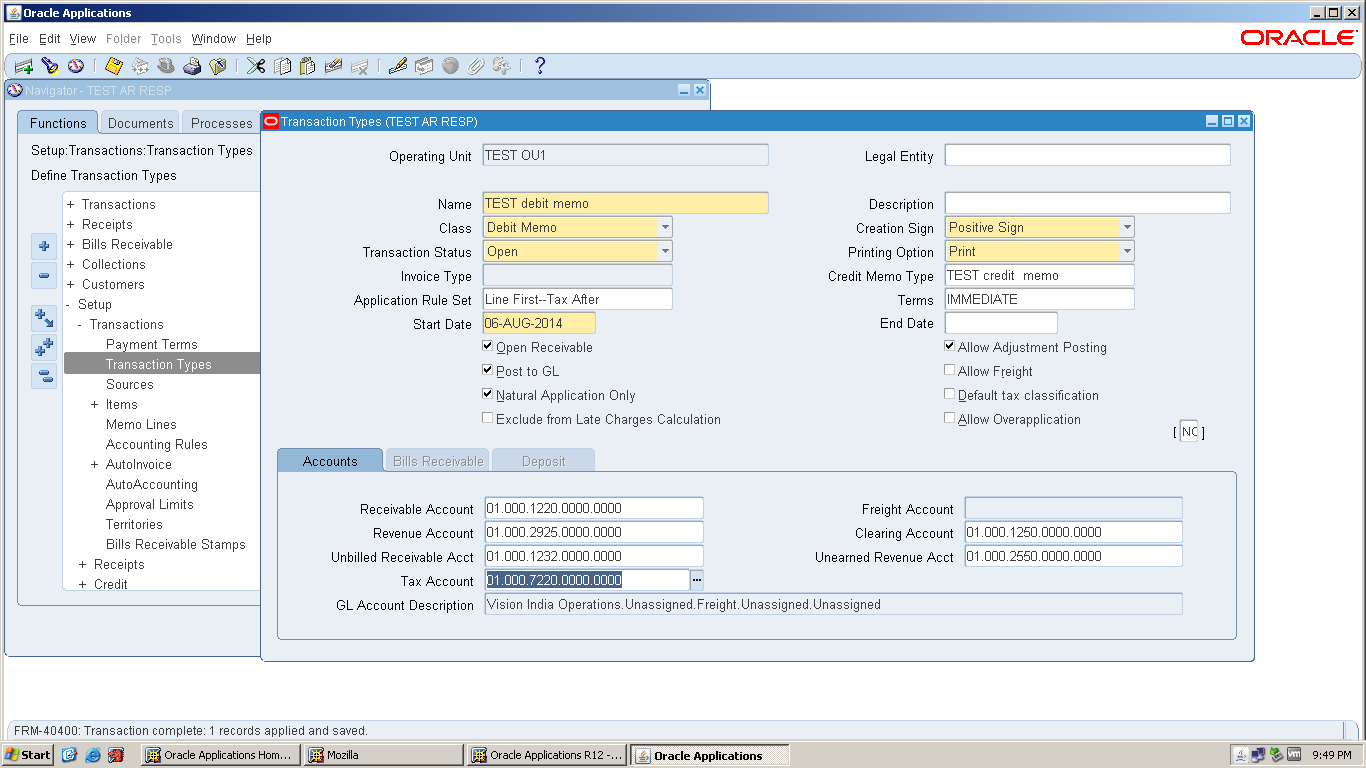

Transaction types

Use

transaction types to define the accounting for the debit memos, credit memos,

on-account credits, chargebacks, commitments, invoices, and bills receivable

you create in Receivables. Transaction types also determine whether your

transaction entries update your customers' balances and whether Receivables

posts these transactions to your general ledger.

If

AutoAccounting depends on transaction type, Receivables uses the general ledger

accounts that you enter here, along with your AutoAccounting rules, to

determine the default revenue, receivable, freight, tax, unearned revenue,

unbilled receivable, and AutoInvoice clearing accounts for transactions you create

using this type. For bills receivable, the accounts that you enter here

determine the bills receivable, unpaid bills receivable, remitted bills

receivable, and factored bills receivable accounts for a bill receivable.

To define a transaction type:

1.

Navigate

to the Transaction Types window.

2.

Select

an operating unit and legal entity for this transaction type.

Receivables

uses the selected legal entity to default for transactions using this

transaction type. Enter a Name and Description for this transaction type..

3.

Enter

a Class for this transaction type. Choose from the following classes: Invoice,

Chargeback, Credit Memo, Debit Memo, Deposit, or Guarantee.

If you choose Deposit or Guarantee,

Receivables sets Open Receivable and Post to GL to Yes, Allow Freight, Default

Tax Classification, and Allow Overapplication to No, Creation Sign to 'Positive

Sign,' and Natural Application Only to Yes. You cannot change these options.

4.

Choose

a Creation Sign. The default is Positive Sign for transaction types with a

class of either Guarantee or Deposit. You cannot update this field after you

enter transactions with this type.

5.

Choose

a Transaction Status of Open, Closed, Pending, or Void. Use these statuses to

implement your own invoice approval system. Enter 'Void' to void debit memos,

on-account credits or invoices to which you assign this transaction type.

6.

Choose

a default Printing Option for transactions with this transaction type. Choose

Print or Do Not Print. You can override this value when entering transactions.

7.

If

this transaction type's class is either Deposit or Guarantee, enter the Invoice

Type to use for invoices entered against commitments or deposits with this

transaction type. When you enter an invoice against either a deposit or a guarantee

with this transaction type, the value you enter here is the default invoice

transaction type.

8.

If

this transaction type's class is Deposit, Guarantee, Debit Memo, or Invoice,

enter the Credit Memo Type to use when crediting items with this transaction

type (optional). When you enter a credit memo against an invoice with this

transaction type, the value you enter here is the default credit memo

transaction type.

9.

Enter

an Application Rule Set for this transaction type or select one from the list

of values (optional). An Application Rule Set determines the default payment

steps when you use the Applications window or AutoLockbox to apply receipts to

transactions using this type. If you do not enter a rule set, Receivables uses

the rule set in the System Options window as the default

10. Enter the

payment Terms to use for transactions with this transaction type.

Any

payment terms entered at the customer level will override the payment terms

that you enter here.

11. Enter the range

of dates that this transaction type will be active. The default Start Date is

today's date, but you can change it. If you do not enter an End Date, this

transaction type will be active indefinitely.

12. If this

transaction type's class is not Deposit or Guarantee, indicate whether you want

transactions with this type to update your customer balances by checking or

unchecking the Open Receivable box.

If

Open Receivable is set to Yes, Receivables updates your customer balances each

time you create a complete debit memo, credit memo, chargeback, or on-account

credit with this transaction type. Receivables also includes these transactions

in the standard aging and collection processes.

13. To allow freight

to be entered for transactions with this transaction type, check the Allow

Freight box.

14. To be able to

post transactions with this type to your general ledger, check the Post To GL

box. The default is the value you specified for the Open Receivables option.

This box must be checked if the class is Deposit or Guarantee. If you leave

this box unchecked, then no accounting will be generated for transactions with

this type. If you leave this box unchecked, then no accounting will be

generated for transactions with this type.

If

you are defining a 'void' transaction type, do not check this box.

15. To automatically

assign a default tax classification on transaction lines, select the Default

tax classification box.

16. If this

transaction type's class is not Deposit or Guarantee and you want to restrict

the direction in which items with this transaction type can be updated by

applications entered against them, check the Natural Application Only box. If

you check this box, Receivables sets Allow Overapplication to No.

17. If this transaction type's class is not

Deposit or Guarantee, and you did not check the Natural Application Only box,

choose whether to Allow Overapplication against items with this transaction

type by checking or unchecking this box. You can update these options.

18. Select the

Exclude from Late Charges Calculation box if you do not want to assess late

charges on overdue transactions using this transaction type.

19. If this

transaction type's class is Invoice, Chargeback, Credit Memo, Debit Memo, or

Guarantee, then define the accounting for this transaction type in the Accounts

tabbed region.

20.

Enter

the Receivable Account for transactions with this transaction type. Receivables

uses this information, along with your AutoAccounting definition, to determine

the receivable accounts for transactions with these types. Receivables creates

a receivables transaction record using this account so you can transfer to your

general ledger and create a journal entry if Post To GL is Yes for this

transaction type.

21. Enter a Freight

Account for transactions with this transaction type. Receivables uses this

information, along with your AutoAccounting definition, to determine the freight

account for transactions with this transaction type. Receivables skips this

field if this transaction type's class is Guarantee or if Allow Freight is set

to No.

22. Enter a Revenue

Account for transactions with this transaction type. Receivables skips this

field if Allow Freight is set to No. Receivables uses this information, along

with your AutoAccounting definition, to determine the revenue account for

transactions with this transaction type.

23. If this

transaction type's class is Invoice or Debit Memo, enter a Clearing Account for

transactions with this transaction type. Receivables uses this account to hold

any difference between the revenue amount specified for the Revenue account and

the selling price times the quantity for imported invoice lines. Receivables

only uses the clearing account if you have enabled this feature for transaction

sources that you use for your imported transactions.

24. If this

transaction type's class is Invoice or Credit Memo, enter an Unbilled

Receivable Account. When you use the Bill In Arrears invoicing rule,

Receivables uses this information, along with your AutoAccounting definition,

to determine the Unbilled Receivable account for transactions with this

transaction type.

25. If this

transaction type's class is Invoice or Credit Memo, enter an Unearned Revenue

Account. Receivables uses this information, along with your AutoAccounting

definition, to determine the unearned revenue account for transactions with

this transaction type. Receivables only uses this account when your

transaction's invoicing rule is Bill In Advance.

26. If this

transaction type's class is Invoice, Credit Memo, or Debit Memo, enter a Tax

Account. Receivables uses this information along with your AutoAccounting

definition to determine the tax account for transactions with this transaction

type.

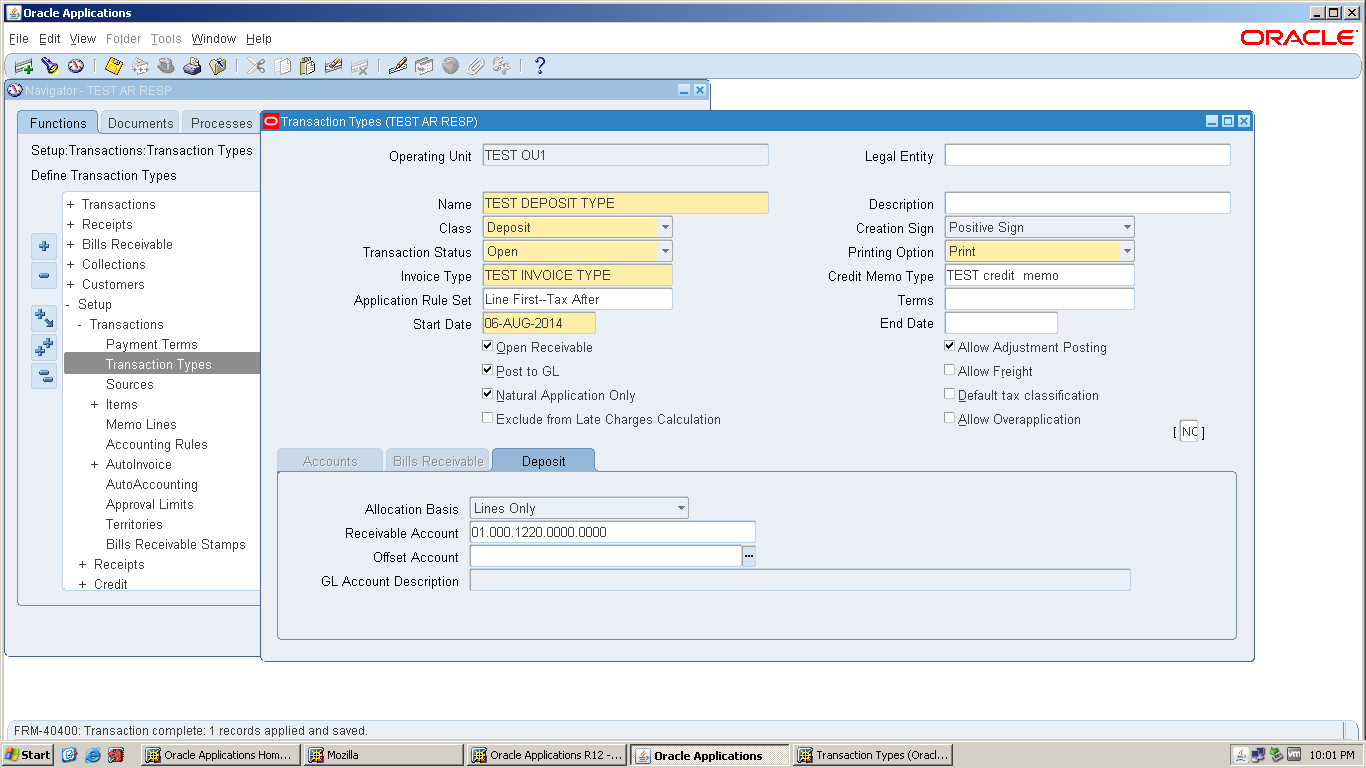

27. If this

transaction type's class is Deposit, then complete these fields in the Deposit

tabbed region:

In the Allocation Basis field, indicate

how you want to apply the balance of deposits with this transaction type to

transactions.

You

can select Lines Only to apply deposits to invoice lines only. Or, you

can select Lines, Tax and Freight to include tax and freight amounts on

invoices when applying deposits to transactions.

creating Credit memo Transaction type

creating invoiceTransaction type

creating debit memo Transaction type

creating Deposit Transaction type

creating Deposit Transaction type

creating chargeback Transaction type

Transaction Batch Sources

Batch sources control the standard

transaction type assigned to a transaction and determine whether Receivables

automatically numbers your transactions and transaction batches. Active

transaction batch sources appear as list of values choices in the Transactions,

Transactions Summary, and Credit Transactions windows, and for bills receivable

in the Bills Receivable and Bills Receivable Transaction Batches windows.

Note:

A

batch source provides default information, which you can optionally change at

the transaction level.

You

can define two types of transaction batch sources:

Manual: Use manual

batch sources with transactions that you enter manually in the Transactions and

Transactions Summary windows, and for bills receivable transactions.

Credit

memos that are created by the Credit Memo workflow also use manual batch

sources.

Imported: Use imported

batch sources to import transactions into Receivables using AutoInvoice.

You

can make a batch source inactive by unchecking the Active check box and then

saving your work. Receivables does not display inactive transaction batch

sources as list of values choices or let you assign them to your transactions

Bills

receivable batch sources: After you define batch sources for bills

receivable, enter a batch source in the profile option AR: Bills Receivable

Batch Source. Prerequisites

Define

credit memo batch sources (optional)

Define grouping rules (optional)

To define a transaction batch

source:

1.

Navigate

to the Transaction Sources window.

2.

Select

an operating unit and legal entity.

3.

Enter

a Type of 'Manual' or 'Imported.' For bills receivable batch sources, enter

'Manual.'

4.

Enter

the range of Effective Dates for this source. The Start date is the current

date, but you can change it. If you do not enter an end date, this transaction

batch source will be active indefinitely.

5.

If

this is a Manual source and you want to automatically number new batches you

create using this source, or if this is a Manual source for bills receivable

and you want to generate bills receivable automatically, check the Automatic

Batch Numbering box and enter a Last Number. For example, to start numbering

your batches with 1000, enter 999 in the Last Number field. If you are defining

an Imported transaction batch source, Receivables automatically numbers the

batch with the batch source name - request ID.

6.

To

automatically number new transactions you create using this source, check the

Automatic Transaction Numbering box and enter a Last Number. You can use

automatic transaction numbering with both Imported and Manual sources.

7.

To

use the same value for both the document number and the transaction number for

transactions assigned to this source, check the Copy Document Number to

Transaction Number box (optional).

8.

Select

the Allow Duplicate Transaction Numbers box to allow duplicate transaction

numbers within this batch source.

Selecting

the Copy Document Number to Transaction Number box automatically selects this

option.

This

option and the Automatic Transaction Numbering box, however, are mutually

exclusive.

9.

Select

the Copy Transaction Information Flexfield to Credit Memo check box if you want

to copy an invoice's Transaction Information flexfield data to a related credit

memo that uses this batch source (optional).

10. Select Generate

Line Level Balances to calculate and populate the line level balances for

invoices created using this transaction source.

11. Indicate your

enterprise's policy for automatic receipt handling for imported credits against

paid invoices (optional).

Set

this option only if you want AutoInvoice to automatically evaluate imported

credits for receipt handling.

12. In the Reference

Field Default Value, enter the Invoice Transaction Flexfield attribute that you

want to appear in the Reference field of the Transactions window. Receivables

uses this to further identify the invoice and displays this value under the

Reference column in the invoice list of values in the Applications window.

The

default value is INTERFACE_HEADER_ATTRIBUTE1.

13. Enter the

Standard Transaction Type for this batch source. When you choose a batch source

during transaction entry, this is the default transaction type. You can define

new transaction types in the Transaction Types window.

14. To number your

credit memos created against invoices and commitments with this source differently

than the invoices or commitments they are crediting, enter a Credit Memo Batch

Source. Before you can assign a credit memo batch source, you must first define

your credit memo batch sources using this window. If you do not specify a

credit memo batch source, Receivables enters the invoice or commitment batch

source here.

15. If you are

defining a Manual transaction batch source, then you have completed this task.

If

you are defining an Imported transaction batch source, open the AutoInvoice

Processing Options tabbed region.

16. Specify how you

want AutoInvoice to handle imported transactions that have Invalid Tax Rates.

An invalid tax rate is one in which the imported transaction's tax rate does

not match its tax code. Enter 'Correct' if you want AutoInvoice to

automatically update the tax rate that you supplied to the one that you defined

previously for the tax code. Enter 'Reject' if you want AutoInvoice to reject

the transaction.

17. Specify how you

want AutoInvoice to handle imported transactions with Invalid Lines by entering

either 'Reject Invoice' or 'Create Invoice.'

18. Specify how you

want AutoInvoice to handle imported transactions that have lines in the

Interface Lines table that are in a closed period. To have AutoInvoice

automatically adjust the GL dates to the first GL date of the next open or

future enterable period, enter 'Adjust' in the GL Date in a Closed Period

field. Enter 'Reject' to reject these transactions.

19. Enter a Grouping

Rule to use for a transaction line (optional). If you do not enter a grouping

rule, AutoInvoice uses the following hierarchy to determine which rule to use:

The grouping rule specified in the

Transaction Sources window for the batch source of the transaction line.

The grouping rule specified in the

Customer Profile Classes window for the bill-to customer and bill-to site of

the transaction line.

The grouping rule specified in the

Customer Profile Classes window for the bill-to customer of the transaction

line.

The default grouping rule specified in

the System Options window.

20. Check the Create

Clearing box if you want AutoInvoice to require that the revenue amount for

each transaction line is equal to the selling price times the quantity

specified for that line. Use this option to distribute revenue on an

transaction in an amount that is not equal to the transaction line amount.

21. Indicate whether

sales credits can be entered for transactions using this source by checking or

unchecking the Allow Sales Credit box. This option and the Require Salesreps

option in the System Options window determine whether sales credits are

optional or required.

22. Open the

Customer Information tabbed region, then choose either 'Value' or 'ID' for each

option to indicate whether AutoInvoice validates your customer information for

this batch source using a value or identifier. Choose 'None' for no validation.

23. Open the

Accounting Information tabbed region, then choose ID, Value, or None to

indicate how AutoInvoice validates your Invoice and Accounting Rule data for

this batch source.

24. Choose either

'Id' or 'Segment' to indicate whether you want AutoInvoice to validate the

identifier or the flexfield segment for this batch source.

25. Check the Derive

Date check box to derive the default rule start date and default GL date from

the ship date, rule start date, order date and the default date that you supply

when you submit AutoInvoice.

26. Choose either

'Id' or 'Value' to indicate whether AutoInvoice validates your Payment Terms

for this batch source using identifiers or values.

27. Choose either

'Amount' or 'Percent' to indicate how you want AutoInvoice to validate your

Revenue Account Allocation data for this batch source.

28. Open the Other

Information tabbed region, then choose how you want AutoInvoice to validate

data. Choose 'None' if you do not want AutoInvoice to import this information.

Note:

Even

if you choose 'None,' AutoInvoice might still validate the data and could

reject the containing line(s) if that data is invalid.

29. Open the Sales

Credits Data Validation tabbed region, then choose how you want AutoInvoice to

validate data for salespersons, sales credit types and sales credit. Choose

Number, ID, or Value to validate information using identifiers, numbers, or

values for this batch source. Choose to validate Sales Credits based on either

Amount or Percent.

creating transaction source for invoice transaction

creating transaction source for chargeback transaction

creating transaction source for guarantee transaction

creating transaction source for deposit transaction

creating transaction source for debit memo transaction

creating transaction source for credit memo transaction

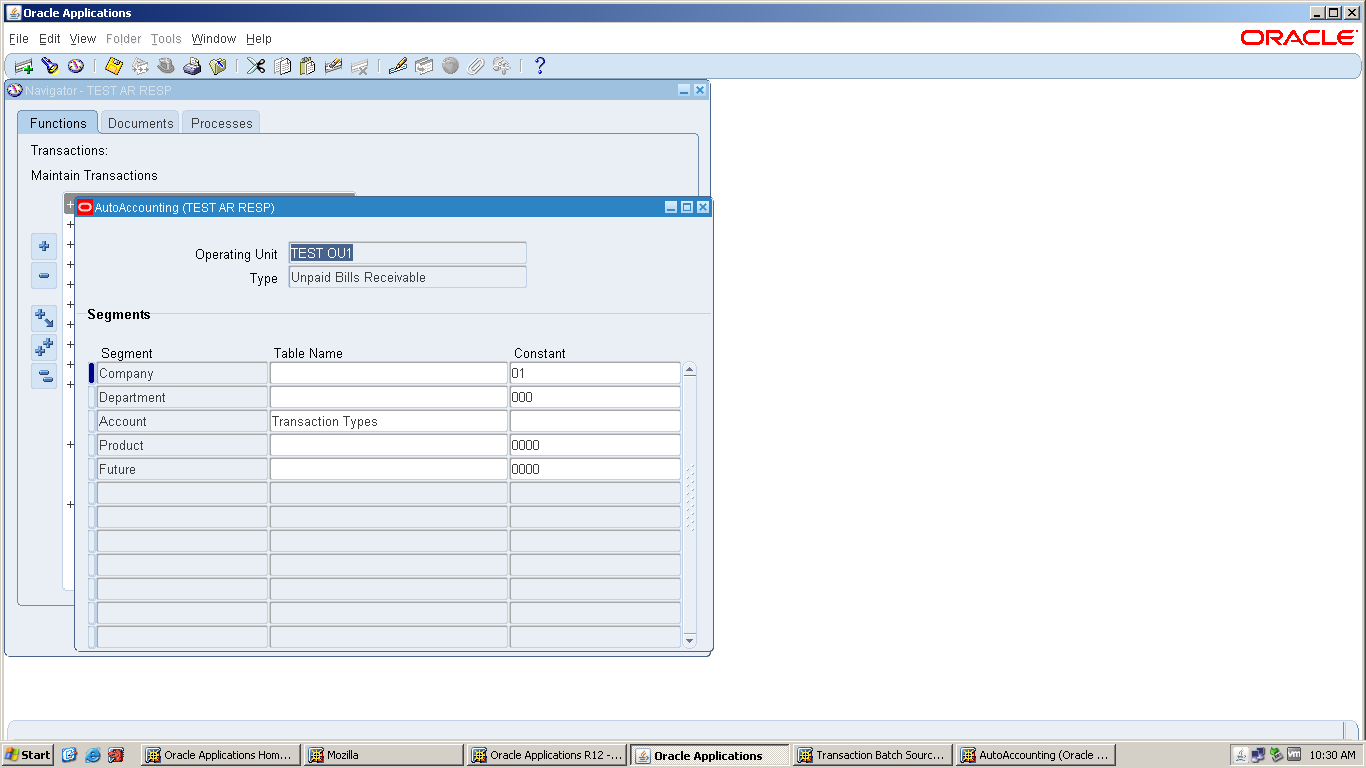

AutoAccounting

Define

AutoAccounting to specify how you want Receivables to determine the default

general ledger accounts for transactions that you enter manually or import

using AutoInvoice. Receivables creates default accounts for revenue,

receivable, freight, tax, unearned revenue, unbilled receivable, late charges,

bills receivables accounts, and AutoInvoice clearing (suspense) accounts using

this information.

The

default accounting that AutoAccounting creates is considered interim accounting

only. Receivables integrates with Oracle Subledger Accounting, the E-Business

Suite's centralized accounting engine, which accepts the default accounts that

AutoAccounting derives without change. However, you can modify the accounting

rules in Subledger Accounting to create accounting that meets your business

requirements.

You

can control the value that AutoAccounting assigns to each segment of your

Accounting Flexfield, such as Company, Division, or Account.

You

must define AutoAccounting before you can enter transactions in Receivables.

When you enter transactions in Receivables, you can override the default

general ledger accounts that AutoAccounting creates.

Suggestion:

If

you use the multiple organization support feature, you can set up

AutoAccounting to derive the Product segment of your Revenue account based on

inventory items. To do this, define the Product segment of your Revenue account

to use Standard Lines and specify a Warehouse ID when entering transactions.

To define AutoAccounting:

1.

Navigate

to the AutoAccounting window.

2.

Select

an operating unit.

3.

Enter

the Type of account to define. Choose from the following:

AutoInvoice Clearing: The clearing

account for your imported transactions. Receivables uses the clearing account

to hold any difference between the specified revenue amount and the selling

price times the quantity for imported invoice lines. Receivables only uses the

clearing account if you have enabled this feature for the invoice batch source

of your imported transactions.

Bills Receivable: The bills

receivable account for your transaction. Receivables uses this account when you

exchange transactions for bills receivable.

Factored Bills Receivable: The factored

bills receivable account for your bills receivable transactions.

Freight: The freight

account for your transaction.

Receivable: The receivable

account for your transaction.

Remitted Bills Receivable: The remitted

bills receivable account for your bills receivable transactions.

Revenue: The revenue and

late charges account for your transaction.

Tax: The tax account for your

transaction.

Unbilled Receivable: The unbilled

receivable account for your transaction. Receivables uses this account when you

use the Bill In Arrears invoicing rule. If your accounting rule recognizes

revenue before your invoicing rule bills it, Receivables uses this account.

Unearned Revenue: The unearned

revenue account for your transaction. Receivables uses this account when you

use the Bill In Advance invoicing rule. If your accounting rule recognizes

revenue after your invoicing rule bills it, Receivables uses this account.

Unpaid Bills Receivable: The unpaid

bills receivable account for your bills receivable transactions.

4.

For

each segment, enter either the table name or constant value that you want

Receivables to use to get information. When you enter an account Type,

Receivables displays all of the segment names in your Accounting Flexfield

Structure. Segments include such information as Company, Product, Department,

Account, and Sub-Account. Receivables lets you use different table names for

different accounts. Choose one of the following table names:

Bill To Site: Use the bill-to

site of the transaction to determine this segment of your revenue, freight,

receivable, AutoInvoice clearing, tax, unbilled receivable, and unearned

revenue account.

Drawee Site: Use the drawee

site table to determine this segment of your bills receivable, factored bills

receivable, remitted bills receivable, and unpaid bills receivable account.

Remittance Banks: Use the

remittance banks table to determine this segment of your factored bills

receivable and remitted bills receivable account.

Salesreps: Use the

salesperson's table to determine this segment of your revenue, freight,

receivable, AutoInvoice clearing, tax, unbilled receivable, and unearned

revenue account. If you choose this option for your AutoInvoice clearing, tax,

or unearned revenue accounts, Receivables uses the revenue account associated

with this salesperson. If you choose this option for your unbilled receivable

account, Receivables uses the receivable account associated with this

salesperson. If the transaction has a line type of "LINE" with an

inventory item of freight ("FRT"), AutoAccounting uses the accounting

rules for the freight type account rather than the revenue type account.

Standard Lines: Use the

standard memo line or inventory item on the transaction to determine this

segment of your revenue, AutoInvoice clearing, freight, tax, unbilled

receivable, and unearned revenue account. If you choose this option for your

AutoInvoice clearing, freight, tax, unbilled receivable or unearned revenue

accounts, Receivables uses the revenue account associated to this standard memo

line item or inventory item. If the transaction has a line type of

"LINE" with an inventory item of freight ("FRT"),

AutoAccounting uses the accounting rules for the freight type account rather

than the revenue type account.

Taxes: Enter this option to use tax

codes when determining your tax account.

Transaction Types: Use the

transaction types table to determine this segment of your revenue, freight,

receivable, AutoInvoice clearing, tax, unbilled receivable, and unearned

revenue account, and of your bills receivable, factored bills receivable,

remitted bills receivable, and unpaid bills receivable account. If the

transaction has a line type of "LINE" with an inventory item of

freight ("FRT"), AutoAccounting uses the accounting rules for the

freight type account rather than the revenue type account.

5.

If

you did not enter a Table Name, enter a Constant value for this segment, or

select one from the list of values.

Attention:

If

you modify the Oracle Subledger Accounting setup to define custom accounting,

then select a constant value for all Accounting Flexfield segments.

Enter

a Constant value if you want AutoAccounting to always use the same value for

this Accounting Flexfield segment. Be sure to enter information that is valid

for this segment. For example, if you defined your Company flexfield segment as

a two-character segment with valid values ranging from 00 to 10, you must enter

a two-character value within this range.

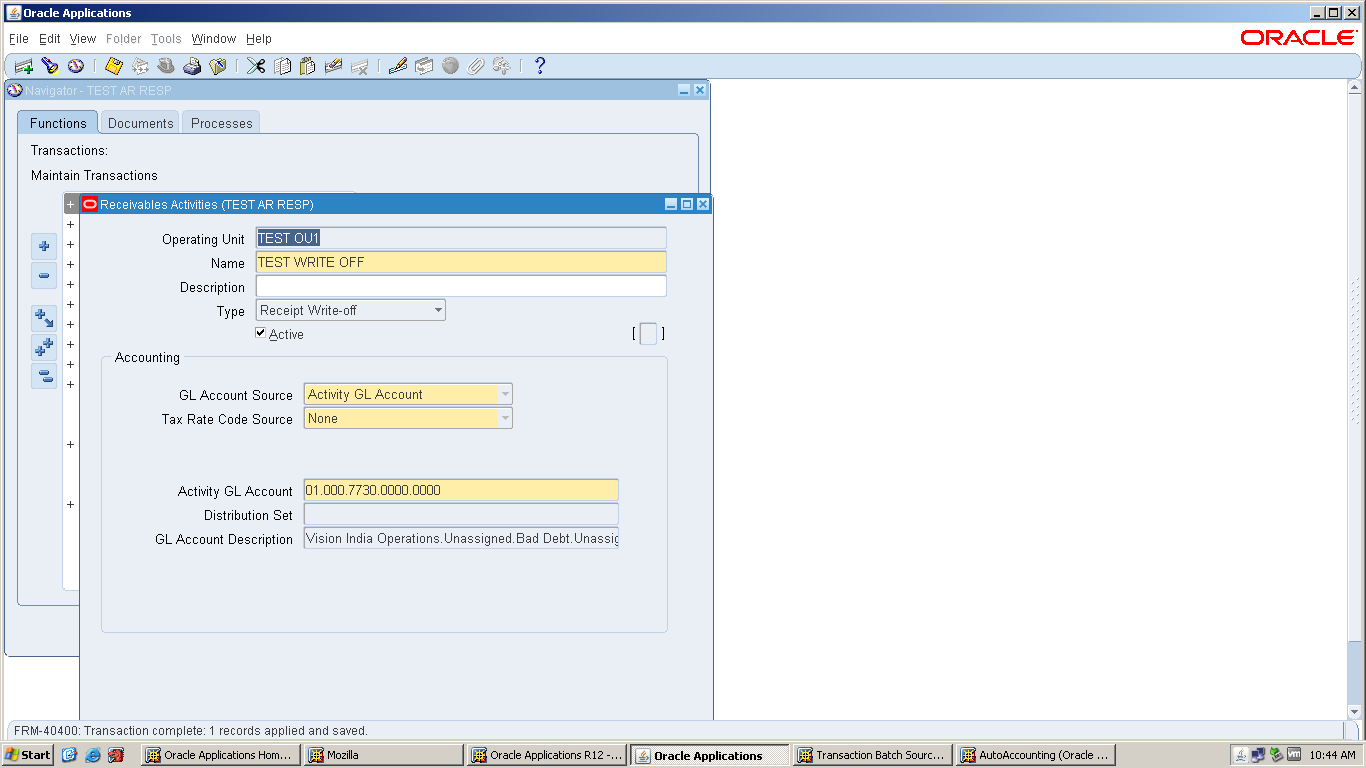

Receivables Activities

Define

receivables activities to default accounting information for certain

activities, such as miscellaneous cash, discounts, late charges, adjustments,

and receipt write-off applications. See: Activity Types for a complete list of activities.

Activities

that you define appear as list of values choices in various Receivables

windows. You can define as many activities as you need.

The

Tax Rate Code Source you specify determines whether Receivables calculates and

accounts for tax on adjustments, discounts, and miscellaneous receipts assigned

to this activity. If you specify a Tax Rate Code Source of Invoice, then

Receivables uses the tax accounting information defined for the invoice tax

rate code(s) to automatically account for the tax. If the Receivables Activity

type is Miscellaneous Cash, then you can allocate tax to the Asset or Liability

tax accounts that you define for this Receivables Activity.

Receivables

uses Late Charges activity's accounting information when you record late

charges as adjustments to overdue transactions. See: Setting Up Late Charges.

Query

the Chargeback Adjustment activity that Receivables provides and specify GL

accounts for this activity before creating chargebacks in Receivables.

Query

the Credit Card Chargeback activity that Receivables provides and specify a GL

clearing account for this activity, before recording credit card chargebacks in

Receivables.

You

can make an activity inactive by unchecking the Active check box and then

saving your work.

Attention:

Once

you define an activity, you cannot change its type. However, you can update an

existing activity's GL account, even if you have already assigned this activity

to a transaction.

Prerequisites

If

you use Receivables with an installed version of Oracle General Ledger, your

Accounting Flexfields are already set up. If you are using Receivables as an

Oracle Financials standalone product, you must define the Accounting Flexfield

and the GL accounts for each receivables activity that you plan to use to

reflect your current accounting structure.

An

activity's type determines whether it uses a distribution set or GL account and

in which window your activity appears in the list of values. You can choose

from the following types:

Adjustment:

You

use activities of this type in the Adjustments window. You must create at least

one activity of this type.

Note:

In

the Adjustments window, you cannot select the Adjustment Reversal, Chargeback

Adjustment, Chargeback Reversal, and Commitment Adjustment activities to

manually adjust transactions. These four activities are reserved for internal

use only, and should not be end dated.

When

you reverse a receipt, if an adjustment or chargeback exists, Receivables

automatically generates off-setting adjustments using the Adjustment Reversal

and Chargeback Reversal activities. When your customers invoice against their

commitments, Receivables automatically adjusts the commitment balance and

generates an off-setting adjustment against the invoice using the Commitment

Adjustment activity.

Bank

Error:

You use activities of this type in the Receipts window when entering

miscellaneous receipts. You can use this type of activity to help reconcile

bank statements using Oracle Cash Management.

Claim

Investigation: You

use activities of this type in the Receipts Applications and QuickCash windows

when placing receipt overpayments, short payments, and invalid Lockbox

transactions into claim investigation. The receivable activity that you use

determines the accounting for these claim investigation applications.

For

use only with Oracle Trade Management.

Credit

Card Chargeback:

Use activities of this type in the Receipts Applications window when recording

credit card chargebacks. This activity includes information about the General

Ledger clearing account used to clear the chargebacks. Receivables credits the

clearing account when you apply a credit card chargeback, and then debits the

account after generating the negative miscellaneous receipt. If you later

determine the chargeback is invalid, then Receivables debits the clearing

account when you unapply the credit card chargeback, and then credits the

account after reversing the negative miscellaneous receipt. Only one activity

can be active at a time.

Credit

Card Refund: You

use activities of this type in the Receipts Applications window when processing

refunds to customer credit card accounts. This activity includes information

about the General Ledger clearing account used to clear credit card refunds.

You must create at least one activity of this type to process credit card

refunds.

Earned

Discount:

You use activities of this type in the Adjustments and the Remittance Banks

windows. Use this type of activity to adjust a transaction if payment is

received within the discount period (determined by the transaction's payment

terms).

Endorsements: The endorsement

account is an offsetting account that records the endorsement of a bill

receivable. This is typically defined with an Oracle Payables clearing account.

Late

Charges:

You use activities of this type in the System Options window when you define a

late charge policy. You must define a late charge activity if you record late

charges as adjustments against overdue transactions. If you assess penalties in

addition to late charges, then define a separate activity for penalties.

Miscellaneous

Cash:

You use activities of this type in the Receipts window when entering

miscellaneous receipts. You must create at least one activity of this type.

Payment

Netting:

You use activities of this type in the Applications window and in the QuickCash

Multiple Application window when applying a receipt against other open

receipts.

The

GL Account Source field defaults to Activity GL Account and you must

enter a GL account in the Activity GL Account field. The GL account that you

specify will be the clearing account used when offsetting one receipt against

another receipt. The Tax Rate Code Source field defaults to None.

You

can define multiple receivables activities of this type, but only one Payment

Netting activity can be active at any given time.

Prepayments: Receivables

uses activities of this type in the Applications window when creating

prepayment receipts. When the Prepayment activity type is selected, the GL

Account Source field defaults to Activity GL Account and you must enter

a GL account in the Activity GL Account field. The GL account that you specify

will be the default account for prepayment receipts that use this receivables

activity. The Tax Rate Code Source field defaults to None. You can

define multiple receivables activities of this type, but only one prepayment

activity can be active at any given time.

Receipt

Write-off: You

use activities of this type in the Receipts Applications and the Create Receipt

Write-off windows. The receivable activity that you use determines which GL

account is credited when you write off an unapplied amount or an underpayment

on a receipt.

Refund: Use activities

of this type in the Applications window to process automated non-credit card

refunds. This activity includes information about the General Ledger clearing

account used to clear refunds. Create at least one activity of this type. Only

one activity can be active at a time.

Short

Term Debt:

You use activities of this type in the GL Account tabbed region of the

Remittance Banks window. The short-term debt account records advances made to

creditors by the bank when bills receivable are factored with recourse.

Receivables assigns short-term debt receivables activities to bills receivable

remittance receipt methods.

Unearned

Discount:

You use activities of this type in the Adjustments and the Remittance Banks

windows. Use this type of activity to adjust a transaction if payment is

received after the discount period (determined by the transaction's payment

terms).

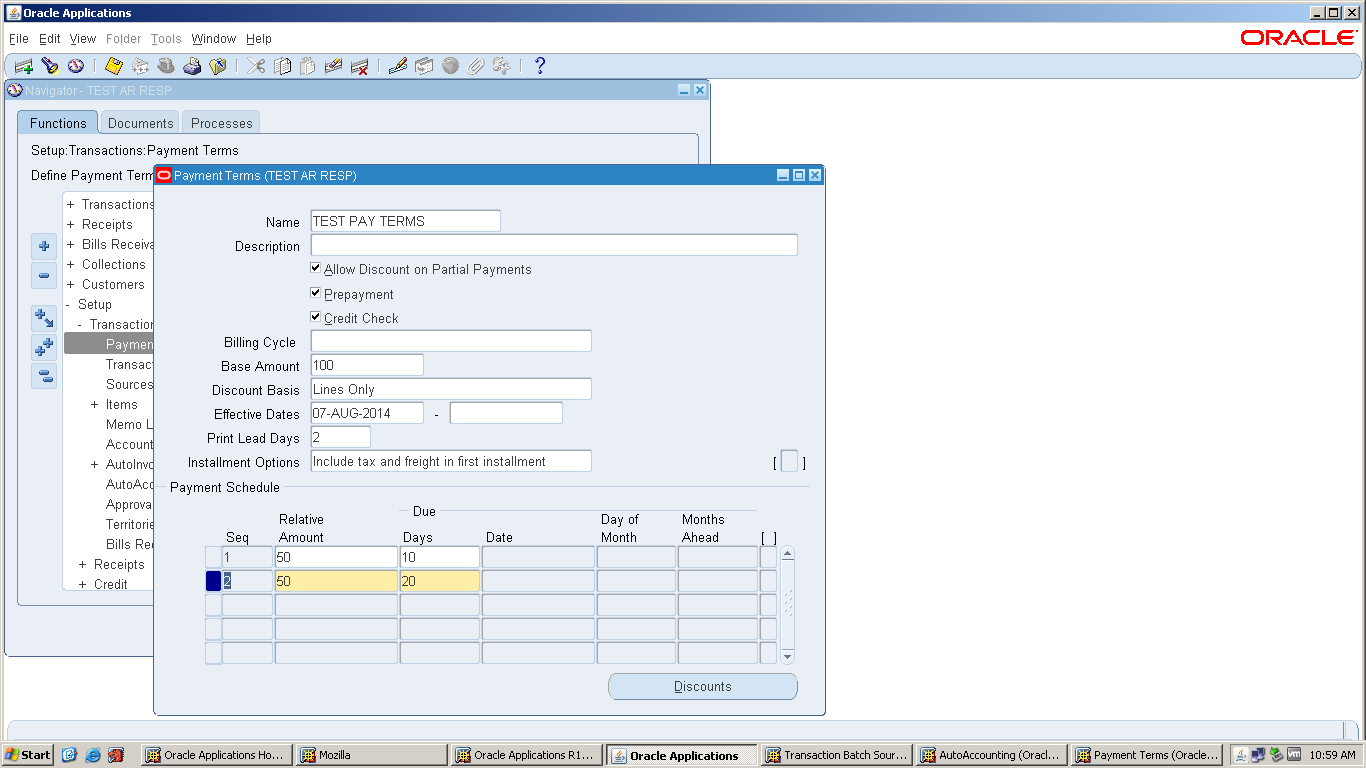

Payment

Terms

Receivables

lets you define standard payment terms for your customers to specify the due

date and discount date for their open items. Payment terms can include a

discount percent for early payment and you can assign multiple discounts to

each payment term line. For example, the payment term '2% 10, Net 30' indicates

that a customer is allowed a two percent discount if payment is received within

10 days; after 10 days, the entire balance is due within 30 days of the

transaction date with no applicable discount.

You

can define balance forward payment terms to bill customers periodically (daily,

weekly, or monthly) at the account or site level using balance forward billing.

The balance forward bill for a billing period shows the previous balance

carried over from the last billing period, payment received, current charges

and activities, and current total outstanding balance

You

can also create split payment terms for invoice installments that have

different due dates.

You

can use payment terms to determine the amount of each installment. Receivables

lets you either distribute tax and freight charges across all installments, or

allocate all freight and tax amounts in the first installment of a split term

invoice. You can use prepayment payment terms to indicate which business

transactions require prepayment for goods and services. Receivables displays

the active payment terms you define as list of values choices in the Customers,

Customer Profile Classes, and Transactions windows.

Default Payment Terms Hierarchy

Receivables

uses the following hierarchy to determine the default payment term for your

transactions, stopping when one is found:

1.

Bill-to

site

2.

Customer

Address

3.

Customer

4.

Transaction

Type

Predefined Payment Terms

Receivables

provides the following predefined payment terms:

30

NET:

The balance of the transaction is due within 30 days.

IMMEDIATE: The balance of

the transaction is due immediately (i.e. on the transaction date). You can use

this payment term with your chargebacks and debit memos.

To define a payment term:

1.

Navigate

to the Payment Terms window.

2.

Enter

the Name of this payment term.

3.

Select

the Prepayment check box if you are defining a prepayment payment term.

Receivables

feeder systems, such as Oracle Order Management, can optionally implement

business processes around prepayment payment terms to indicate that a particular

business transaction requires the capture of funds before the delivery of a

product or service.

4.

To associate a credit check with this payment

term, check the Credit Check box. Oracle Order Management uses this information

to determine when to place an order on hold.

In

Oracle Order Management, if the profile for an address does not have credit

checking limits defined in a particular currency but the customer does, then

the order passes credit check. If the address does not have limits in the

currency and neither does the customer, then the order is compared to the

customer limit in that currency.

5.

If

you do not want to let your customers take discounts for partial payments on

items associated with this payment term, then uncheck both the Allow Discount

on Partial Payments check box as well as the check box for the Discount on

Partial Payment system option.

6.

Enter

the Installment Option for items assigned to this payment term. This indicates

how Receivables will allocate the freight and tax charged to transactions using

this payment term. Choose 'Include tax and freight in first installment' to

include all tax and freight charges in the first installment. Choose 'Allocate

tax and freight' to distribute tax and freight charges across all installments.

7.

Enter

the Base Amount for this payment term. The default is 100, but you can change

it. The base amount is the denominator for the ratio Receivables uses to

determine the amount due for installments of invoices to which you assign this

payment term. The sum of the relative amounts for all of the payment schedules

that you define for these payment terms must be equal to the value that you

specify as a base amount

8.

If

you want to use this payment term for balance forward billing, select an

appropriate balance forward billing cycle from the Billing Cycle LOV. See:

Note:

You

cannot update the billing cycle, once a balance forward billing payment term is

attached to a profile.

Because

balance forward bills cannot be split across installments, in the case of a

balance forward payment term:

Any value entered in Base Amount

defaults to 100.

Installment Options becomes disabled and

any data entered before selecting a cycle defaults to Include tax and freight

in first installment.

You can populate only one row in the

Payment Schedule section and the Sequence Number and Relative Amount values for

the row default respectively to 1 and 100.

Date Due becomes disabled. However, you

can populate Days, Day of Month, and Months Ahead.

Note:

You

cannot change existing payment terms from regular payment terms to balance

forward billing payment terms and vice versa.

9.

If

you want transactions assigned to this payment term to be printed before the

due date, enter a number of Print Lead Days. Receivables will print this

transaction x number of days before the due date, where x is the

number of days you enter here.

10. Enter the

Discount Basis you want Receivables to use when calculating discounts for your

invoices. Choose one of the following discount methods:

Invoice

Amount:

Choose this option to calculate the discount amount based on the sum of the

tax, freight charges, and line amounts of your invoices.

Lines

Only:

Choose this option to calculate the discount amount based on only the line

amounts of your invoices.

Lines,

Freight Items and Tax: Choose this option to calculate the discount amount

based on the amount of line items, freight, and tax of your invoices, but not

freight and charges at the invoice header level.

Lines

and Tax, not Freight Items and Tax: Choose this option to calculate the

discount amount based on the line items and their tax amounts, but not the

freight items and their tax lines, of your invoices.

11. Enter a range of

Effective Dates for this payment term. If you do not enter an end date, this

payment term will be active indefinitely.

12. Enter a line

number for the installment term that you are defining in the 'Seq' field. Enter

a higher number for each installment term with a later due date. For example,

if you create terms with 50% due in 15 days and 50% in 30 days, enter '1' in

this field for the first line and '2' for the second line.

13. Enter the

Relative Amount for this payment term. This is the numerator of the ratio that

Receivables uses to determine the amount due for this installment of these

payment terms. The sum of the relative amounts for all of the payment schedules

that you define for each payment term must be equal to the base amount for this

term.

14. Enter the number

of Days after the invoice date that payment is due for this installment term

(optional). For split payment terms, this number indicates the number of days

after the invoice date that an installment is due.

15. Enter the Date

on which payment is due for this installment term (optional). If you do not

complete this field, enter a value for either Due Days or both Day of Month and

Months Ahead.

16. If you are

defining proxima terms, enter the Day of Month that payment is due for this

installment term. For example, if payment is due on the fifteenth of each

month, enter '15.'

17. If you are

defining proxima terms and you entered a value for Day of Month, enter the

Months Ahead to which this installment term of the proxima terms refer. For

example, if you entered '15' for Day of Month and you enter '2' here, an

invoice dated in May will have a due date of July 15.

18. Save your work.

To assign discounts to each payment schedule line of your payment term,

Statement

Cycles

Define

statement cycles to determine when to send statements to your customers. You enter

statement cycles when you define or modify individual customer and site profile

classes in the Customer Profile Classes window.

If

a customer site is defined as a statement site, Receivables generates a single,

consolidated statement for all of this customer's transactions. This statement

is sent to this statement site. If you have not defined a statement site for a

customer, Receivables creates statements for each customer site to which you

have assigned a Bill-To business purpose and for each credit profile that has

the Send Statements parameter set to Yes.

You

choose a statement cycle when you print your statements. Active statement

cycles appear as list of values choices in the Print Statements and Customer

Profile Classes windows. Statement cycle dates appear as list of values choices

in the Print Statements window.

You

can disable a statement cycle by unchecking the Active box, and then saving

your work.

To define a

statement cycle:

1.

Navigate

to the Statement Cycles window.

2.

Enter

a Name and Description for this statement cycle.

3.

Enter

the Interval for this statement cycle to indicate how often Receivables will

generate your statements. You can choose Weekly, Monthly, or Quarterly.

4.

Select

an operating unit.

5.

Enter

Statement Dates for this statement cycle. Receivables uses the statement date

to determine past due items and calculate late charges.

6.

To

prevent Receivables from printing a statement on a specific statement date,

check the Skip box.

Note: The Date Printed field displays

the last date you printed statements from the Print Statements window for each

statement date within a statement cycle. Receivables does not display a printed

date for statement dates that you have either elected to skip or have not yet

selected for a statement submission.

Receivables populates this field only if

you print statements for all customers who are assigned to this

statement cycle.

Collectors

Receivables lets you define collectors

and assign them to a profile class, or directly to a customer account or site.

When you assign a collector to a profile class, that collector becomes the

collector for all customers assigned that profile class. You can modify

collector assignments for your customers in the Customers pages, and for your

profile classes in the Customer Profile Classes window.

Receivables

displays active collectors and their descriptions as list of values choices in

the Customers pages and in the Customer Profile Classes window. Receivables

does not display inactive collectors in the list of values for these windows.

You

can make an existing collector inactive by unchecking the Active check box and

then saving your work. If the collector you want to make inactive is associated

with an active customer, Receivables displays a warning message.

Integration with Oracle Advanced

Collections

Receivables

integrates with Oracle Advanced Collections to provide you with a complete

collections management solution.

Due

to this integration, Advanced Collections requires that collectors defined in

Receivables must also be defined as resources in Oracle Resource

Manager. For existing Receivables collectors, you can create resources for use

in Advanced Collections using one of two methods:

In

Oracle Advanced Collections, submit the IEX: AR Collectors to Resource

Collectors concurrent program.

Suggestion:

To

avoid the creation of duplicate records, submit this concurrent program only

once.

Use

Resource Manager to create the resource, and assign the resource a role with a

role type of Collections.

For new

collectors, you can create resources using Resource Manager. Next, create

matching collectors in Receivables using your Receivables responsibility.

Advanced Collections uses the collector that

is defaulted from the profile class, or assigned directly to the customer

account or site, when assigning a collector to a delinquency.

Suggestion:

If

you have purchased a separate license for Advanced Collections, then you can

use Territory Manager to determine the collector and automatically populate the

collector on the customer record.

To define a collector in

Receivables:

1.

Navigate

to the Collectors window.

2.

Enter

a Name and Description for this collector. For example, enter the collector's

first name in the Name field and full name in the Description field.

3.

Enter

a Correspondence Name and Telephone Number for this collector (optional). This

information appears on your dunning letters if you enter it when formatting

your dunning letters.

4.

If

you use the Credit Memo Request Approval workflow, enter the collector's

employee name or select it from the list of values. Receivables uses this

information to ensure that the collector is also an employee and therefore can

receive workflow notifications.

AutoCash

Rule Sets

Define

AutoCash Rule Sets to determine the sequence of AutoCash Rules that Post

QuickCash uses to update your customer's account balances. You specify the

sequence and the AutoCash Rules for each AutoCash Rule Set. The AutoCash Rule

Sets you define display as list of values choices in the Customers, Customer

Addresses, Customer Profile Classes, and the System Options windows. Post

QuickCash first checks the customer site, then the customer profile class, and

finally at the system options level to determine the AutoCash Rule Set to use.

Receivables

provides a default AutoCash Rule Set when you assign a customer to a credit

profile, but you can modify individual AutoCash Rule Set assignments at both

the customer and customer site levels. If you do not assign an AutoCash Rule

Set to a customer's credit profile, and you enter a receipt for this customer,

Receivables uses the AutoCash Rule Set that you entered in the System Options

window along with the number of Discount Grace Days you specified in this

customer's credit profile to apply the receipt. If you assign an AutoCash Rule

Set to a customer, but none of the AutoCash Rules apply, Receivables places the

remaining amount Unapplied or On-Account, depending on how you set the

Remaining Remittance Amount option for the rule set.

If

you have set up your system to use bank charges and a tolerance limit, Post

QuickCash will also consider these amounts if the current AutoCash rule fails

(this is true for all rules except 'Apply to the Oldest Invoice First'). If it finds

a match, Post QuickCash applies the receipt; otherwise, it looks at the next

rule in the sequence. For more information,

You can disable an existing AutoCash Rule Set

by changing its status to Inactive and then saving your work.

Prerequisites

To define an

AutoCash Rule set:

1.

Navigate

to the AutoCash Rule Sets window.

2.

Enter

the Name of this AutoCash rule set.

3.

Enter

a description for this AutoCash rule set (optional).

4.

Enter

the type of Discount you want to automatically give to your customer for this

AutoCash Rule Set. Choose one of the following Discount options:

Earned Only: Your customer

can take earned discounts according to the receipt terms of sale. You negotiate

earned discount percentages when you define specific receipt terms. You can

enter this option if Allow Unearned Discounts is set to Yes in the System

Options window. In this case, Receivables only allows earned discounts for this

AutoCash Rule Set.

Earned and Unearned: Your customer

can take both earned and unearned discounts. An unearned discount is one taken

after the discount period passes. You cannot choose this option if the system

option Unearned Discounts is set to No.

None: Your customer cannot take

discounts (this is the default).

5.

To

include transactions in dispute when calculating your customer's open balance,

check the Items in Dispute check box.

6.

To

include late charges when calculating your customer's open balance, check the

Finance Charges check box.

8.

If

this rule set will include the Apply to the Oldest Invoice First rule, choose

how you want to apply any Remaining Remittance Amount. Receivables uses this

value to determine how to enter the remaining amount of the receipt if none of

the AutoCash Rules within this rule set apply. Choose 'Unapplied' to mark

remaining receipt amounts as Unapplied. Choose 'On-Account' to place remaining

receipt amounts On-Account.

9.

To

automatically apply partial receipts when using the Apply to the Oldest Invoice

First rule, check the Apply Partial Receipts check box. A partial receipt is

one in which the receipt minus the applicable discount does not close the debit

item to which this receipt is applied.

The applicable discount that Receivables

uses for this rule depends upon the value you entered in the Discounts field

for this AutoCash Rule Set. If you exclude late charges (by setting Finance

Charges to No) and the amount of your receipt is equal to the amount of the

debit item to which you are applying this receipt minus the late charges,

Receivables defines this receipt as a partial receipt. In this case,

Receivables does not close the debit item because the late charges for this

debit item are still outstanding.

If Apply Partial Receipts is set to No,

this AutoCash Rule Set will not apply partial receipts and will either mark the

remaining receipt amount 'Unapplied' or place it on-account, depending on the

value you entered in the Remaining Remittance Amount field (see step 8).

10. Enter a Sequence

number to specify the order of each rule in this AutoCash Rule Set (optional).

Receivables uses the rule assigned to sequence 1, then sequence 2, and so on

when applying receipts using this AutoCash Rule Set.

11. Enter one or

more AutoCash Rules for this AutoCash rule set. Choose from the following

AutoCash rules:

Apply to the Oldest Invoice First: This rule

matches receipts to debit and credit items starting with the oldest item first.

This rule uses the transaction due date when determining which transaction to

apply to first. This rule uses the values you specified for this AutoCash Rule

Set's open balance calculation to determine your customer's oldest outstanding

debit item.

Post QuickCash uses the next rule in the

set if any of the following are true:

all of your

debit and credit items are closed

the entire

receipt amount is applied

it encounters a

partial receipt application and Allow Partial Receipts is set to No for this

AutoCash Rule Set

the next oldest

debit item includes late charges and Finance Charges is set to No for this

AutoCash Rule Set

This rule marks any remaining receipt

amount 'Unapplied' or places it on-account, depending on the value you entered

in the Remaining Remittance Amount field for this AutoCash Rule set (see step

8).

Clear the Account: Post QuickCash

uses this rule only if your customer's account balance exactly matches the

amount of the receipt. If the receipt amount does not exactly match this

customer's account balance, Post QuickCash uses the next rule in the set. This

rule calculates your customer's account balance by using the values you

specified for this AutoCash Rule Set's open balance calculation and the number

of Discount Grace Days in this customer's profile class. This rule also

includes all of this customer's debit and credit items when calculating their

account balance. This rule ignores the value of the Apply Partial Receipts

option.

This AutoCash Rule uses the following

equation to calculate the open balance for each debit item:

Open Balance = Original Balance + Late

Charges - Discount

Receivables then adds the balance for

each debit item to determine the customer's total account balance. The 'Clear

the Account' rule uses this equation for each invoice, chargeback, debit memo,

credit memo, and application of an Unapplied or On-Account receipt to a debit

item.

Note: The discount amount for each item

depends upon the payment terms of the item and the value of the Discounts field

for this AutoCash Rule Set. The number of Discount Grace Days in this

customer's credit profile, along with the payment terms assigned to their

outstanding invoices, determine the actual due dates of each debit item.

Clear Past Due Invoices: This rule is

similar to the 'Clear the Account' rule because it applies the receipt to your

customer's debit and credit items only if the total of these items exactly

matches the amount of this receipt. However, this rule only applies the receipt

to items that are currently past due. A debit item is considered past

due if its due date is earlier than the receipt deposit date. This rule

considers credit items (i.e. any pre-existing, unapplied receipt or credit

memo) to be past due if the deposit date of the receipt is either the same as

or later than the deposit date of this pre-existing receipt or credit memo. In

this case, this rule uses a pre-existing receipt or credit memo before the

current receipt for your AutoCash receipt applications.

If this AutoCash Rule Set's open balance

calculation does not include late charges or disputed items, and this customer

has past due items that are in dispute or items with balances that include late

charges, this rule will not close these items. This rule ignores the value of

the Apply Partial Receipts option.

Clear Past Due Invoices Grouped by

Payment Term: This

rule is similar to the 'Clear Past Due Invoices' rule, but it first groups past

due invoices by their payment term, and then uses the oldest transaction due

date within the group as the group due date. When using this rule, Receivables

can only apply the receipt if the receipt amount exactly matches the sum of

your customer's credit memos and past due invoices.

A debit item is considered past due if

the invoice due date is earlier than the deposit date of the receipt you are

applying. For credit memos, Receivables uses the credit memo date to determine

whether to include these amounts in the customer's account balance. For

example, if you are applying a receipt with a receipt date of 10-JAN-93, credit

memos that have a transaction date (credit memo date) on or earlier than

10-JAN-93 will be included. Credit memos do not have payment terms, so they are

included in each group.

Match Payment with Invoice: This rule

applies the receipt to a single invoice, debit memo, or chargeback that has a

remaining amount due exactly equal to the receipt amount. This rule uses the

values that you enter for this AutoCash Rule Set's open balance calculation to

determine the remaining amount due of this customer's debit items. For example,

if Finance Charges is No for this rule set and the amount of this receipt is

equal to the amount due for a debit item minus its late charges, this rule

applies the receipt to that debit item. If this rule cannot find a debit item

that matches the receipt amount, Post QuickCash looks at the next rule in the

set. This rule ignores the value of the Apply Partial Receipts option.

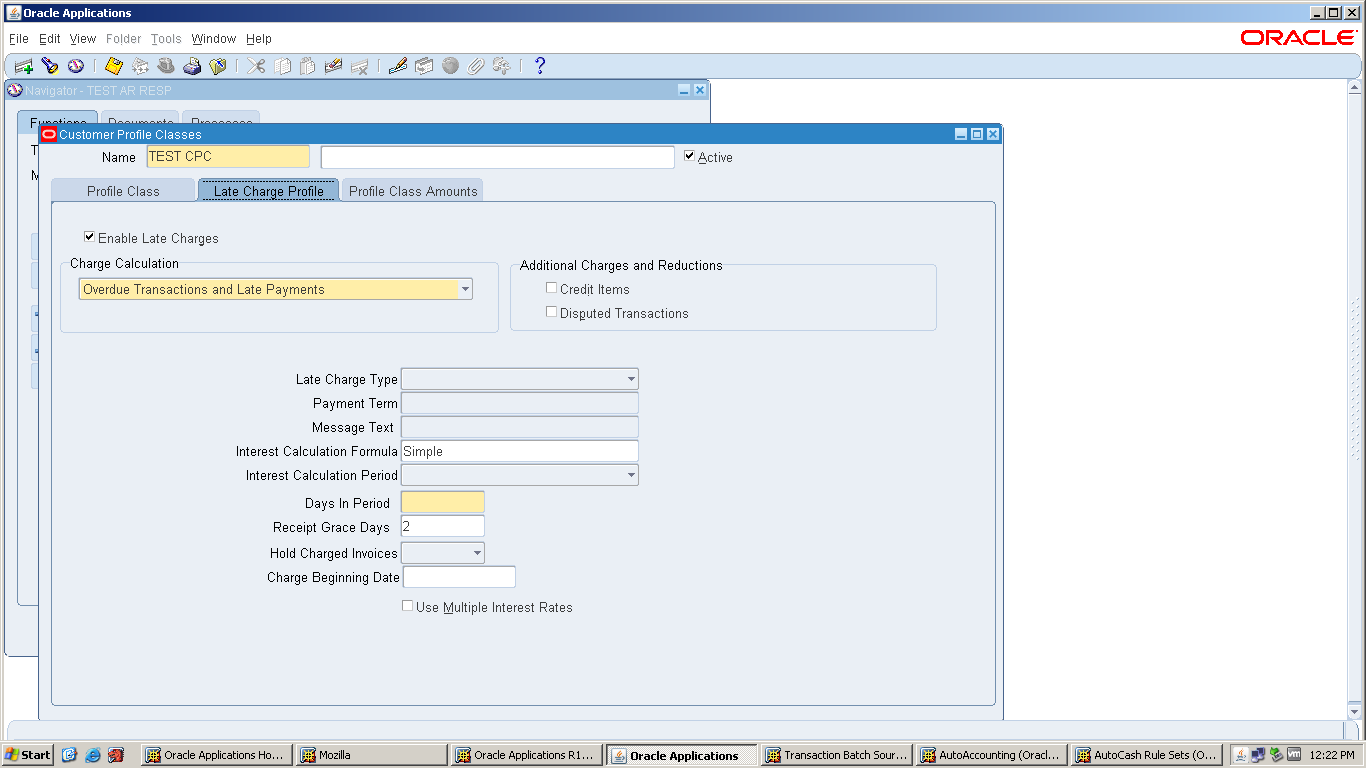

Use

Customer Profiles to group customer accounts with similar creditworthiness,

business volume, payment cycles, and late charge policies. For each profile

class you can define information such as credit limits, payment terms,

statement cycles, invoicing, and discount information. You can also define

amount limits for your late charges and statements for each currency in which

you do business.

Define

your standard customer profiles in the Customer Profile Classes window. These

profiles contain generic options that you can use to group your customers into

broad categories.

For

example, you might define three categories: one for prompt paying customers; one

for late paying customers with high late charge rates; and a third for

customers who mostly pay on time, with discount incentives for early payment.

You can also use the profile class 'DEFAULT,' which Oracle Receivables

provides.

You

can assign a profile class to customer accounts and sites on the Create

Customer page or the Account Profile subtab of the Account Overview page. The

customer profile class you assign provides the default values, which you can

optionally customize to meet specific requirements for each account or site.

Profile

class options set at the account or site level take precedence over those

defined at the customer profile class level.

For

statement site, dunning site, and late charges site profile amounts,

Receivables uses the profile amounts defined at the site level only if

the site is assigned a dunning, statement, or late charge business purpose and

you set the AR: Use Statement, Dunning, and Late Charges Site Profiles profile

option to Yes. Otherwise, Receivables uses the profile amounts defined

on the billing site.

Prerequisites

Optionally

define interest tiers and charge schedules, if you are using charge schedules

when calculating late charges.

To define a new customer profile

class:

1.

Navigate

to the Customer Profile Classes window.

2.

Enter

a Name and a brief description of this profile class.

3.

Check

the Active check box to make this profile class active.

Attention:

Active

profile classes appear in the Profile Class list on the Create Customer page or

the Account Profile subtab of the Account Overview page.

4.

Enter

other profile class information.

5.

Use

the Late Charge Profile tab to enter default information for late charge

calculations.

6.

Open

the Profile Class Amounts tabbed region, then enter the Currency in which

customers assigned to this profile class will do business. For each currency

that you enter, define the currency rates and limits for customers using this

profile class, including Credit Limit and exchange rate information.

You

also use this tab to continue defining your late charge policy.

Attention: If you do not assign an interest

rate to a currency, Receivables does not calculate late charges for past due

items in that currency.

Note:

If

Credit Management is installed, then Credit Management matches the currencies

assigned in the profile class with the credit usage rules in Order Management

to identify the transactions to include in a credit review.

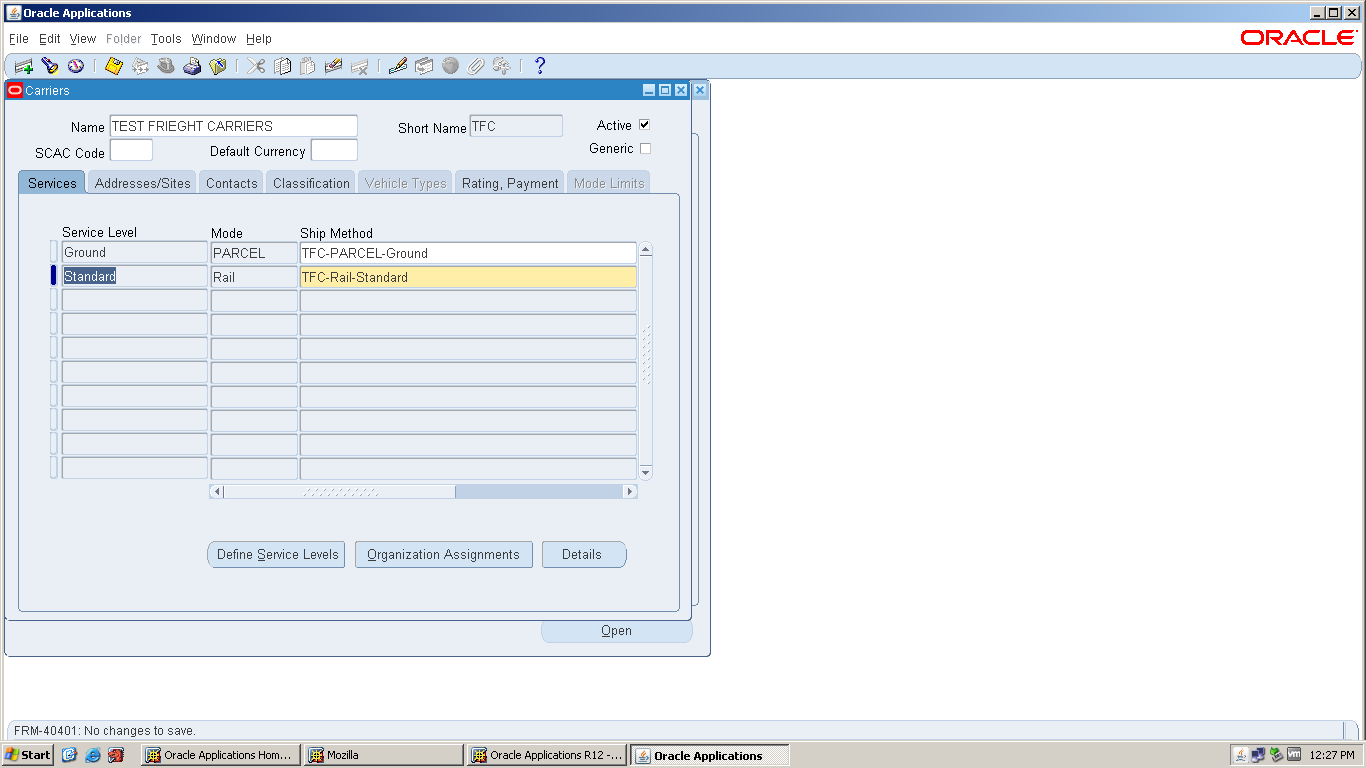

Defining Freight Carriers and Ship Methods

A

freight carrier is a commercial company that transports shipments to and from

customers, suppliers, and internal organizations. You must set up each

carrier's information as a party in Oracle Shipping Execution before shipping

goods; you should assign a carrier to each delivery. You also must associate a

general ledger account with each carrier to collect associated costs.

Before

you set up the carriers:

Collect general information about each

carrier

Determine the types of services that

your carriers offer and that you use

Open

and close accounting periods in your calendar to control the recording of

accounting information for these periods. Receivables lets you open future

accounting periods while your current period is still open. Receivables also

lets you reopen previously closed accounting periods and enter receivables

activities without transferring transactions to the general ledger when you set

your accounting periods to 'Future.'

Define

your receivables calendar in the Accounting Calendar window. Receivables

references the statuses of these accounting periods to control transaction

entry and journal entry creation to your general ledger. You cannot enter an

activity in a closed accounting period.

When

you close an accounting period, Receivables automatically generates the Collection Effectiveness Indicators report.

An

accounting period can have one of the following statuses:

Closed:

Journal

entry, posting, and transaction entry are not allowed unless the accounting

period is reopened. Receivables verifies that there are no unposted items in

this period. Receivables does not let you close a period that contains unposted

items.

Close

Pending: Similar

to Closed, but does not validate for Unposted items. Journal entry, posting,

and transaction entry are not allowed unless the accounting period is reopened.

Future: This period is

not yet open, but you can enter transactions in this period. However, you cannot

post in this period until you open it.

Not

Opened:

This period has never been opened and journal entry and posting are not

allowed.

Open: Journal entry

and posting are allowed.

1.

Navigate to the Open/Close Accounting Periods window.

2.

To update the status of an accounting period, place the cursor in the Status

field next to that period, then enter a new status.

3.

To open the next accounting period after the Latest Open Period, choose Open

Next Period. Receivables changes the status of the next period to 'Open.'

4.

Save your work.